Lost opportunity of carbon market reform leaves a lot to fix in ancillary laws

On 13 December 2022, the European Commission, Council and Parliament reached a provisional agreement on the Carbon Border Adjustment Mechanism that will partly replace the free allocation of emissions permits to polluters covered by its carbon market. This marks the end of a two-year phase following the decision by the 27 EU Member States in December 2020 to reduce their emissions by 55% by 2030, compared to 1990 levels. A provisional agreement was also reached (on 18 December) on reforming the carbon market itself. These agreements still need to be ratified by the Parliament and the Council over the next few months.

Although no written version of the deal is yet available, Sandbag has received preliminary extracts from Members of the European Parliament. Here are highlights of the deal and our reactions, based on those extracts.

Ambition of the Carbon Market (Emissions Trading Scheme – ETS)

|

The scheme’s emissions cap for 2030 will be strengthened to 62% compared with 43% currently. The linear reduction factor (LRF), i.e., the pace at which emissions must be decreased each year, will be increased from 2.2% currently to 4.3% for 2024-2027, and 4.4% for 2028-2030. There will be an extra reduction of the cap (“rebasing”) of 90 million emissions permits in 2025 and 27 million in 2026 in order to achieve these new objectives. The Market Stability Reserve (MSR) thresholds were not modified, at 833 million and 400 million for the high and low thresholds. The surplus calculation method has been changed: the aviation deficit will stop being added to surplus figures, which is effectively equivalent to increasing the thresholds compared with what they were going to be in the current legislation. |

The 2030 reduction cap merely reflects the overall ambition level of the EU: 62% for ETS sectors is consistent with 55% reduction for the EU. However, a large surplus of emissions permits will keep allowing emissions to exceed this cap by large amounts.

Rebasing has diverted a lot of attention. Sandbag had asked for a one-off cap reduction to realign it with historical emissions, equivalent to over 200m tCO2e, and the agreed 117m is only half that amount. In May 2022, the ENVI committee of the Parliament had actually passed Sandbag’s proposal so we nearly believed that it would make it to the plenary vote. In the end, the final deal reflects the initial Commission’s proposal, which will keep generating more surplus emissions permits.

Market Stability Reserve (MSR) thresholds have received relatively less attention, but Sandbag tried really hard to have them reduced to a minimum. MSR thresholds are extremely important, as they determine the amount by which emissions are allowed to exceed the system’s cap. The MSR removes some excess permits each year (which can be used by polluters on top of yearly allowances), but only as long as their number remains above the “high” threshold. Currently this threshold stands at 833 million, but a calculation tweak (related to the aviation deficit) means that the “effective threshold” is reduced each year. The deal struck by the parties will stabilise the effective thresholds at their 2024 level for the rest of the decade, at a higher level than what they would have been without the newly agreed upon reforms. Sandbag’s action had helped a significant reduction of the high threshold make it into the Parliament’s proposal: a reduction to 700m of the high threshold by 2024, followed by a yearly decline in the same proportion as the cap, which would have been equivalent to a threshold as low as 380m in 2030 (and the low one equivalent to 225m). Unfortunately, this proposed reduction did not survive the trilogues.

NEXT STEPS

We will shortly update our supply/demand analysis of the EU’s carbon market to reflect this new situation, to inform policymakers before ratification by the Parliament.

Free allocation phase-out, CBAM phase-in and scope

The free allocation of emissions permits to industry will gradually be replaced by a Carbon Border Adjustment Mechanism (CBAM): as the CBAM ramps up for imported goods, free allocation will be reduced for EU-made goods. The timeline is 2,5% in 2026, 5% in 2027, 10% in 2028, 22,5% in 2029, 48,5% in 2030, 55% in 2031, 62,5% in 2032, 80% in 2033 and 100% in 2034.

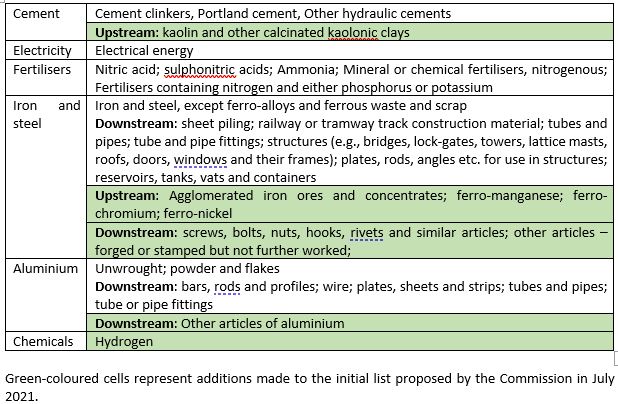

This will only affect the following products:

Replacing the free allocation of emissions permits with a carbon border levy is a very good thing, as free allocation is bad for circularity, low-carbon products and the carbon market.

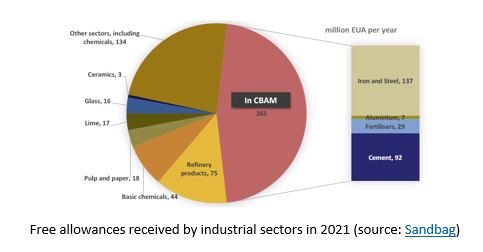

However, the replacement of free allocation with the CBAM will not cover all sectors, as shown by the above table. In a report published in 2021, Sandbag estimated that the value chain of the sectors covered by the CBAM represented 47% of the free allowances given to industry under the EU ETS, based on the list of products initially proposed by the Commission.

Compared to that list, the only extension was to hydrogen production, which adds about 1%. Downstream additions help to avoid circumvention but do not increase coverage. In contrast, the addition of upstream products (“precursors”) only reflects a flaw in the CBAM regulation which will make it impossible to cover the full emissions cycle of products if their upstream products are not explicitly covered by that regulation. As we calculated that precursors of steel and aluminium receiving at least 36 million free allowances each year will not be covered by the CBAM, we can now actually reduce our estimate of the covered emissions down to 42%.

Keeping emissions out of the CBAM contributes to making primary steel and aluminium competitive compared to recycled metals or other low-carbon materials.

Precursors were initially forgotten by all three institutions (Commission, Council and Parliament), and we can safely say that without Sandbag’s action, there would be no precursors in the list of covered products. We are however disappointed that so many precursors were left out, and that our proposal to grant the Commission the ability to add precursors going forward, was not retained.

Most important of all, with the agreed system, the phasing out of free allocation will only happen gradually and slowly: for the covered products, only 48.5% free allocation will have disappeared by 2030 and the fate of the remaining 51.5% will be decided in the scheme’s next phase; the current text mentions 2034 as the tentative phase out date.

NEXT STEPS

As part of the coming review, implementation should be accelerated for sectors with low risk of circumvention. This could be the case of cement products if calculation methodologies for embedded carbon meet certain conditions.

Export rebates

| Member States can use some of the free allowances (up to 50%) reduced by the conditionality provision to support companies whose exports could face carbon leakage. |

Vulnerability to competition outside the EU was a major objection raised by industry to a faster implementation of the CBAM. Export rebates (or more specifically, the continuation of free allocation to production destined for export) would have remedied this problem. Export rebates (for those EU plants exporting products) would not reduce decarbonisation incentives, as they would apply only to products for non-EU markets without carbon pricing.

The agreed system creates little certainty for export rebates, as the number of allowances freed by the conditionality provision is highly uncertain.

NEXT STEPS

As a solution to competition in foreign markets, export rebates could enable the EU to speed up implementation of the CBAM. The export rebate question will be revisited as part of the review by 2025, and we will strongly encourage that the two be introduced together: export rebates with a faster CBAM, which could raise up to €150 billion.

Benchmark Review

|

A review of the free allocation benchmarks will take place prior to 2026. It will “take into account the circular use potential of materials and be independent of the feedstock or type of production process, where the production processes have the same purpose”. However, steel and aluminium will be exempted from this review and will have differentiated benchmarks for primary and secondary production until at least 2030. The benchmark review will also decouple hydrogen from the refineries sector. |

The current free allocation benchmark system is largely based on the way goods are produced rather than the goods themselves: they are process-based. Differentiated benchmarks for the same types of goods create obstacles to cleaner processes, as the more polluting processes receive more permits. For example, in the case of steel, the more polluting blast furnace production route receives 7 to 10 times more free permits than the cleaner electric arc furnace route.

The original Commission ETS revision proposal published in July 2021 included provisions for a full review of the benchmark system to ensure that “free allocation for the production of a product should be independent of the nature of the production process”.

The exemption of steel and aluminium is in direct contradiction to this principle and will perpetuate obstacles to a shift to secondary metallurgy (from recycled materials), which is many times cleaner than primary metallurgy. So we are concerned that the ETS Directive will create excessive constraints on the benchmark review.

The agreement also says that the hydrogen benchmark will be “decoupled”. With regards to hydrogen production, refineries will therefore only be compared to other refineries and “pure player” hydrogen production plants will be compared to other “pure” hydrogen plants. Since the “pure” hydrogen benchmark will include any type of production processes (including very low-carbon ones), it will quickly decrease, whereas the refinery hydrogen benchmark will remain more constant. As a reminder, benchmarks are based on the 10% most efficient plants of their category, and hydrogen produced in refineries is only based on steam methane reforming and partial oxidation. As we showed in one of our recent reports, a large share of the hydrogen consumed by refineries could come from green sources. The above measure will protect refiners from carbon costs and fail to incentivise their switch to green hydrogen consumption.

NEXT STEPS

The errors made with steel and aluminium should not be repeated for other sectors when the benchmark review comes. Even for steel, a fix is actually possible, thanks to the current structure of Europe’s steelmaking fleet. Flat and long steel products could justify different benchmarks for quality reasons, and the split between flat and long steelmaking plants nearly perfectly matches the split between primary and secondary plants. By changing the (process-based) benchmark related to blast furnaces to a (product-based) benchmark for flat steel, the incentive to decarbonise flat steelmaking could be restored. Incentivising decarbonisation is what the benchmark should do.

As the carbon market fails to create an incentive for refineries to switch to green hydrogen consumption, the only measure capable of doing so is a green fuel mandate contained in the Renewable Energy Directive, still under trilogue discussion. This mandate should be set high enough to force a full switch to green hydrogen by 2030, which we demonstrated as highly feasible in our report. We will strongly recommend it.

Innovation financing

|

Size: The Innovation Fund will receive the proceeds from the sale of 600 million emissions permits over 2021-2030 (up from 450m currently). This includes: – 345m taken from free permits (up from 325m currently) – 80m taken from auctioned permits (up from 75m) – 50m unallocated allowances from the MSR (unchanged) – An estimated 125 million allowances to be freed up by the phase in of CBAM by 2030.

Scope: the Fund will remain reserved for innovative projects, with “priority” being given to breakthrough technologies. Extension to maritime sector, buildings and road transport (including hydrogen-based fuels). Subsidies will include direct grants but also competitive bidding (CfDs, CCfDs or fixed premium contracts). A “significant share” shall go to CBAM sectors. The Commission shall publicly report every year on awarded projects and their expected contribution to climate neutrality. Still covers up to 60% of project costs for direct grants but up to 100% for competitive bidding. €12 billion will be taken from the fund to finance the REPowerEU plan for reducing the EU’s dependence on Russian fossil fuels. |

The fund’s extended size will be worth €46 billion at today’s market price (€80 per allowance), but it could easily reach €60 billion if the price goes back to levels reached in 2022 (above €100 per allowance). How the money will be spent is therefore more critical than ever.

As Sandbag’s research showed, the Fund’s current granting approach is too costly and inefficient. Upfront subsidies are used in the wrong way and do not address competitive distortions, leading to high decarbonisation costs instead of incentives to low carbon activities.

To address our first concern (excessive upfront funding), we welcome the introduction of performance-based subsidies such as CCfDs but also CfDs and especially fixed premium contracts. All three contract types are subject to project performance, which means no funds are disbursed until emission reductions actually happen. This is a much-needed improvement from the current direct granting approach, which pays up to 90% of subsidies before measuring any performance, even for low-risk projects.

While we welcome those new contract types, we worry that CCfDs will only benefit projects that already receive free emissions allowances. When those projects are in direct competition with activities not receiving any free allowances (for example circularity), such contracts will only increase the distortion between the two. This is a real concern, for example, in the steel sector where Europe exports over 20 million tonnes of scrap and keeps producing more primary metal instead of reusing it, emitting 40 million tonnes of CO2. We therefore strongly recommend prioritizing CfDs and fixed premium contracts (over CCfDs), over activities not receiving any free allowances.

Giving priority to CBAM sectors would be missing the point. CBAM sectors already receive free allowances, so granting them Innovation Fund money would increase distortions vis-à-vis sectors not receiving free allowances and slow down decarbonisation.

We are also concerned that the existing granting system will remain unchanged. This system, which can pay up to 90% of subsidies without testing project performance, is available to projects regardless of their technology risk. This makes the grantor (i.e., EU tax payers) bear all other risks, including mismanagement, while not helping technology and not incentivising performance. This should be reformed to make direct grants only cover technology risk.

Another source of concern is that the development of green hydrogen production may be promoted at any (economic and environmental) cost. We have repeatedly warned against the dangers posed by poorly designed support for green hydrogen. More generally, the Fund’s project-based approach lacks a general consideration of broader supply chains and the higher environmental relevance of some activities over others.

But our biggest concern is the fund’s persistent requirement to only fund innovation, which leaves a big funding gap for circularity. As incumbent technologies receive free emission allowances and innovative ones receive Innovation Fund money, circularity activities that are not innovative will become even less competitive than they already are. Sandbag had pushed for this requirement to be changed, and we managed to convince the Parliament.

The Parliament’s ETS revision proposal included the creation of a new Climate Investment Fund, which was closer to what Sandbag had suggested (a Carbon Neutrality Fund). Its scope would have been extended to “techniques, processes and technologies that may no longer be considered innovative” as was asked in the Parliament’s report in June 2022. This was later dropped during the ETS trilogues.

NEXT STEPS

On some of the bad aspects of the deal, there seems to be enough vagueness to allow for improvements. Reserving “a significant part” of the funds for CBAM sectors could be minimised in practice. In addition, the Innovation Fund’s implementation is partly left to the discretion of its managing entity, CINEA, which could also help to improve things. For example, the timing of payment and the possible conditioning of upfront funding on risk criteria, were not addressed by the deal. Similarly, broader supply chain concerns (especially on hydrogen) could possibly be included by CINEA. We have already started discussions with CINEA and will try to get those aspects taken into consideration going forward.

Use of revenues

|

100% of MS auctioning revenues from ETS 1 and 2 “shall” be used for climate action. The Modernization Fund’s size will be increased by auctioning 2.5% of allowances for this purpose. The Fund will continue to benefit those countries with GDP per capita under 65% of the EU’s average and its resources may be used for fossil fuels. Gas power plants with emissions values below the Taxonomy’s Do No Significant Harm 250gCO2e/kwh threshold can be financed if justified for energy security. |

“Climate action” is defined by article 10 (3) of the EU ETS Directive, which covers many possibilities, from the compensation to industry for indirect carbon cost (see below) to retraining schemes for people made redundant in regions highly dependent on fossil fuels. However, it does not cover circularity or the workforce training necessary to increase the availability of low-carbon activities.

We had proposed adding the following items to the Directive:

- to promote skill formation in line with the need to adjust professional practices to circularity and the use of low-carbon materials;

- to support the development of a circular economy.

Unfortunately, those proposals were not retained.

NEXT STEPS

Many State support programmes are aiming at developing a hydrogen economy. In some cases, this could lead to wasteful subsidies and even an increase in greenhouse gas emissions. For example, if the hydrogen is produced from renewable energy that is taken away from existing consumers, or if it is used for applications that could be electrified directly, such as heating. We will continue our work advocating for well spent subsidies.

Indirect Cost Compensation

| The mechanism compensating certain electricity-intensive sectors will remain unchanged. |

The current state aid regime allows Member States to compensate extra cost caused by the use of carbon-intensive grid electricity, but not the use of renewable electricity. Although renewable energy is generally cheaper per MWh, its use by industrial facilities typically increases capital and operational costs due to reduced and less predictable operating hours, so the use of renewables remains more expensive for industry.

Unconditional support for the use of carbon-intensive electricity is environmentally wrong as well as detrimental to any shift in industry’s power consumption patterns. It will surely contribute to creating power shortages at peak hours and increase the likelihood of authorities resorting to highly damaging arbitrary power cuts.

NEXT STEPS

A Commission proposal on reforming subsidies frameworks (including guidelines on State aid for climate, environmental protection and energy (CEEAG) and Important Projects of Common European Interest (IPCEI)) is expected by the end of January in order to counteract the US’ Inflation Reduction Act. These guidelines will govern how Member States can give away subsidies without negatively affecting competitiveness inside the Common Market. Sandbag will engage in the State aid reform process to make sure it reduces existing perverse incentives.

ETS 2 and Social Climate Fund

|

The new ETS for fuels used in road transport and buildings will start in 2027. The price ceiling will be 45EUR/tCO2 until at least 2030. In order to ensure this phase-in does not have a negative social impact, the Social Climate Fund will be created and will come into operation one year before ETS 2. The Fund will be assigned up to €65bln assigned from ETS 2 allowances. An additional 25% of the Fund can be composed of MS budget. Up to 37.5% of the Fund can be spent in direct income support. |

ETS Maritime

|

The maritime sector will be included for the first time under the emissions trading system. The sector will be fully phased-in by 2026 and will include 100% of intra-EU and 50% of extra-EU voyages; small island connections within MS will be excluded. 20 million allowances from this auctioning will be allocated to the Innovation Fund for dedicated maritime calls. |

Biggest Losers: Circularity – and Most of Us

The agreed legislation sets bold ambition levels but fails to remove incentives that go against this ambition. This is likely to result in a dysfunctional carbon market with sky-high prices failing to trigger any demand response. It is all set for feeding more resentment against a system that will end up benefiting only a few private interests, at the expense of the majority, industry and citizens alike. Most of all, it is devastating for the circular economy, which will barely be mentioned in the agreed text and in terms so vague they hardly count. Circular metallurgy is explicitly confined as a separate activity from primary metallurgy, with fewer emissions permits. Circularity will be excluded from the benchmark review. Meanwhile, the legislation sets unrealistic reliance on innovative technologies and a hydrogen economy which would drain Europe’s already insufficient low-carbon electricity.

This very bad direction taken by the EU’s carbon market still leaves a few opportunities to control the damage and fix some problems. Many implementation decisions still need to be made on free allocation benchmarks, CBAM, State aid, clean hydrogen and the Innovation Fund, and getting those right could still make a significant difference.

Photo by Nathan Queloz on Unsplash

Read More:

Simulating CDR in the EU ETS: The Risks of Premature Integration

The EU’s 2040 climate targets suggest integrating carbon removals into the ETS — but at what cost? This report uses Sandbag’s simulator to assess whether the risks of premature CDR integration outweigh the benefits.

The EU ETS at a Crossroads

Sandbag’s latest submission to the EU ETS and Innovation Fund consultation calls for clearer rules on free allocation, stronger criteria for funding innovation, and safeguards against misleading carbon accounting practices.

Getting Electrification Right: The broader challenge of induced emissions

Sandbag’s latest report explores how the climate impact of electricity use depends not just on how it’s generated, but also when and where it’s consumed. Using hydrogen as a case study, the report shows how poorly timed renewable electricity use can unintentionally drive-up fossil fuel emissions — and outlines smarter paths to decarbonisation.