Carbon Border Adjustment Mechanism (CBAM)

We advocate for a strong CBAM to phase out the allocation of free emission allowances, address carbon leakage, and accelerate global climate action.

About the CBAM

A carbon policy to prevent carbon leakage

- Carbon leakage is the re-location of emission intensive production from Europe to regions with no carbon pricing or less stringent climate regulations.

- To address carbon leakage, the EU allocates free emission “permits” – also known as “allowances” – to emission-intensive EU industries.

- This free allocation system strongly reduces decarbonisation incentives in the EU.

- The CBAM was created to replace free allocation, thereby unleashing the potential to decarbonise EU industries.

- The CBAM puts a price on greenhouse gases emitted during the production of a list of imported goods, to level the playing field between EU and non-EU industries.

- As the free allocation of emission allowances is phased out, CBAM is phased in, ensuring fair competition and avoiding carbon leakage while setting the right incentives for EU industries

Implementation timeline

- Adoption – 17 May 2023

- Transitional phase – 1 October 2023 – 31 December 2025: A pilot period to gather data on embedded emissions and refine methodologies.

- Start of definitive period – January 2026: Importers must submit yearly reports on imported goods and their verified emissions.

- CBAM gradually replaces free allocation – January 2026 to 2034: Free allocation will be gradually replaced by the CBAM.

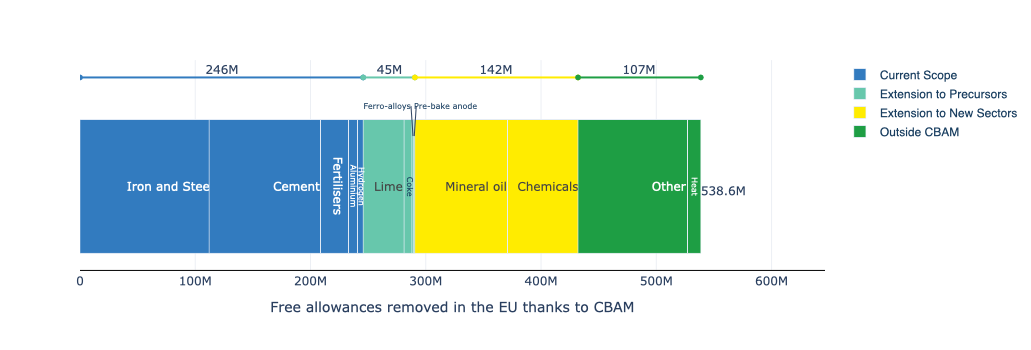

Estimated Phase-Out of Free EU Carbon Allowances (2026–2034) in million tonnes CO₂.

Our work

Researching ways to address the CBAM’s weaknesses

For many years, we’ve been conducting research on:

- Emissions and products covered by the CBAM.

- The impact of the CBAM on trade and competitiveness.

- Reporting requirements and methodologies under the CBAM

Advocating for our solutions

As members of the European Commission’s CBAM Expert Group, we provide evidence-based recommendations to enhance the policy’s effectiveness.

Informing and framing the debate

We share our insights and advocate for improvements, in Europe and beyond, by participating in public events. Recent contributions included:

- 𝗦𝗵𝗮𝗻𝗴𝗵𝗮𝗶 𝗱𝗶𝗮𝗹𝗼𝗴𝘂𝗲 𝗼𝗻 𝗽𝗿𝗲𝘀𝘀𝗶𝗻g energy 𝗮𝗻𝗱 𝗰𝗹𝗶𝗺𝗮𝘁𝗲 𝗶𝘀𝘀𝘂𝗲𝘀, as part of China International Import Expo

- High-level conference on CBAM organised by DG Trésor

- High-level conference on the CID organised by France’s Permanent Representation

Latest publications on CBAM

Our messages

The CBAM is an important climate policy that enables the phase out of free allocation under the EU ETS. Our proposals aim to make the CBAM effective at meeting this objective.

Getting the pricing mechanism right

Including indirect emissions into the CBAM.

Including emissions from inputs such as coke, lime, pre-bake anode.

Avoiding circumvention incentives through e.g. resource shuffling

eg. Attributing emissions to aluminium and steel scrap.

Encouraging the use of default values by our trade partners.

Mitigating circulation of carbon price paid in third country.

Simplifying the system

Increasing the minimum intrinsic value (currently 150 EUR per consignment).

Limiting the inclusion of additional downstream products unless absolutely necessary.

Making the use of default values more systematic.

Our achievements

December 17 2025: Sandbag analysis cited in the European Commission’s CBAM impact assessment

Sandbag analysis was cited in the European Commission’s CBAM impact assessment published on 17 December 2025. The assessment explicitly recognises risks of CBAM circumvention and reflects policy options Sandbag developed on extending CBAM coverage to uncompensated indirect emissions and downstream goods.

Sandbag’s analysis is cited in the Commission’s impact assessment at the following locations:

-

Impact Assessment – Part 1:

pp. 7 and 14

https://taxation-customs.ec.europa.eu/document/download/71d4f753-4a2d-4367-bb10-c1967cb7f28d_en?filename=SWD_2025_988_1_EN_impact_assessment_part1_v4.pdf -

Impact Assessment – Part 2 :

p. 6

https://taxation-customs.ec.europa.eu/document/download/61b0d225-8b3f-42e0-996a-58c228a4bae7_en?filename=SWD_2025_988_1_EN_impact_assessment_part2_v4.pdf

These policy options were set out in Sandbag’s response to the Commission’s public consultation on CBAM reform, published as Strengthening the CBAM by default (August 2025):

December 16 2025: Commission CBAM review reflects Sandbag proposal on uncompensated indirect emissions

In its review of the Carbon Border Adjustment Mechanism published in December 2025, the European Commission sets out technical options to extend CBAM coverage to indirect emissions.

The review considers an option to cover only the share of indirect emissions not compensated under existing electricity compensation schemes, including by using Member State data on actual compensation payments to calculate the uncompensated share (p.48). This approach reflects a proposal developed by Sandbag during the CBAM review process.

Sandbag set out this proposal in its analysis on extending CBAM to indirect emissions, submitted to the Commission earlier in 2025.

Read Sandbag’s analysis:

https://sandbag.be/2025/08/01/why-the-cbam-should-cover-indirect-emissions/

Read the European Commission’s CBAM Review Report:

https://taxation-customs.ec.europa.eu/document/download/3903da9d-44fd-4508-8915-f27ef25fe033_en?filename=Review%20Report_0.pdf

2025: Our warning on post-consumer scrap in the CBAM was initially dismissed but later adopted by European Aluminium

Sandbag consistently warned that excluding embedded emissions from post-consumer scrap under the CBAM would undermine the mechanism’s integrity by enabling circumvention through resource shuffling.

-

February 2023 – Sandbag warned that assuming zero embedded emissions for scrap creates incentives to game the CBAM, allowing exporters to strategically divert scrap to EU-bound products without reducing emissions (“Mind the Scrap: Ignoring Embedded Emissions Puts the CBAM at Risk”).

Read it here -

2023 – Sandbag raised these concerns in discussions with the CBAM Expert Group, where the risks linked to post-consumer scrap were initially dismissed by parts of industry.

-

May 2025 – Sandbag reiterated that the CBAM must be strengthened to prevent circumvention by expanding its scope vertically (to cover key precursors) and horizontally (to cover remaining ETS sectors), explicitly highlighting remaining emissions gaps linked to scrap.

Read it here -

August 2025 – Sandbag detailed how the CBAM’s default emissions reporting method enables circumvention, as steel and aluminium scrap is still treated as having no embedded emissions. This allows exporters to reduce CBAM fees through strategic scrap blending, without delivering real emissions reductions (“Strengthening the CBAM — by default”).

Read it here -

By late 2025, European Aluminium publicly acknowledged the risks associated with post-consumer scrap under the CBAM, aligning with Sandbag’s long-standing position that embedded emissions in scrap must be addressed to safeguard the mechanism against circumvention.

2025: Indian international media relayed Sandbag’s analysis on limited CBAM impacts

Indian international media — typically among the most critical of the EU Carbon Border Adjustment Mechanism (CBAM) — relayed Sandbag’s analysis highlighting that the initial financial impact of the CBAM on Indian exports is likely to be limited.

This coverage helped rebalance public debate by countering narratives portraying the CBAM as a punitive trade measure, and more accurately as a climate tool.

Sandbag’s findings were cited by several major Indian outlets, including:

-

Business Today (India), 17 October 2025

EU’s carbon border fees on Indian exports likely to be minor initially

Read it -

The Hunt (India), 20 October 2025

Relief for India on carbon border tax; initial financial impact limited, but uncertainty remains

Read it -

Indian PSU (India), 20 October 2025

EU’s Carbon Border Fees on Indian Exports Likely to Be Minor Initially: Sandbag Study

Read it

September 2024: Sandbag's CBAM findings on the “scrap loophole” taken up in the Draghi report (2024)

Sandbag’s findings on the CBAM “scrap loophole” — highlighting how the zero-emissions assumption for recycled materials could incentivise circumvention — were relayed in Mario Draghi’s report on European competitiveness (September 2024).

This concern had been raised consistently by Sandbag and was set out in our June 2024 report A Scrap Game: Impacts of the EU Carbon Border Adjustment Mechanism.

Relevant documents:

- Sandbag report – A Scrap Game: Impacts of the EU Carbon Border Adjustment Mechanism (June 2024)

https://sandbag.be/2024/06/03/a-scrap-game/

-

Draghi report, Part A – A competitiveness strategy for Europe

https://commission.europa.eu/document/download/97e481fd-2dc3-412d-be4c-f152a8232961_en -

Draghi report, Part B – In-depth analysis and recommendations

https://commission.europa.eu/document/download/ec1409c1-d4b4-4882-8bdd-3519f86bbb92_en

Read our latest publications

CBAM and Fertiliser Inflation in 2026: The facts behind the numbers

Estimates suggesting that the EU’s Carbon Border Adjustment Mechanism (CBAM) could increase fertiliser prices by up to 30% have brought a central question into focus: how

significant is the inflationary impact likely to be?

The CBAM dividend for Namibia and Ghana

This research note shows that Namibia and Ghana are likely to benefit from the CBAM, as EU price increases linked to the EU ETS outweigh CBAM fees under current exports. It also sets out transparent transformation scenarios, based on announced industrial projects, to show how expanded and lower-emissions production could further increase export revenues over time.

Chemicals in the CBAM: Time to step up

Sandbag’s latest brief explains why the EU CBAM must be expanded to cover key chemical value chains. With chemicals and refinery products responsible for 30% of industry emissions, phased inclusion is critical to prevent carbon leakage and phase out free allowances.

Get involved

Support our efforts to develop an effective CBAM that benefits the climate, the EU, and its trade partners.

WHAT WE DO

TOOLS

PUBLICATIONS

NEWSLETTER

Mundo-b Matogné. Rue d’Edimbourg 26, Ixelles 1050 Belgium.

Sandbag is a not-for-profit (ASBL) organisation registered in Belgium under the number 0707.935.890.

EU transparency register no. 277895137794-73.

VAT: BE0707935890.