Industry decarbonisation

We explore the potential of electrification, circularity, and other technologies to decarbonise energy-intensive sectors like steel, aluminium, and cement.

About industry decarbonisation

Decarbonising heavy industies is key to achieving the EU's net-zero target by 2050

Heavy industries (e.g. chemicals, steel, cement, non-ferrous metals, …) are used in sectors such as construction, transport and agriculture. These industries are amongst the biggest emitters.

Decarbonisation policies and solutions need to be improved and developed to make progress

- EU policies, such as the EU Emissions Trading System (ETS), should better incentivise decarbonisation.

- Electrification, substitutions, and circularity are obvious solutions to decarbonise industry.

- In some cases, other technologies such as hydrogen and carbon capture, utilisation and storage (CCUS) may be useful.

Our work

Conducting research

We analyse the potential of electrification, circularity, and other technologies such as hydrogen and CCUS.

We aim to identify actionable pathways and policy solutions to decarbonise heavy industries.

Evidence-based advocacy

We actively advocate for our data-driven and evidence-based policy recommendations through:

- Expert groups and alliances: We are part the Commission’s Climate Change Policy Expert Group (CCEG) on the Free Allocation Regulation, Carbon Border Adjustment Mechanism (CBAM) expert group for DG CLIMA and DG TAXUD, and DG GROW’s Clean Hydrogen Alliance.

- Collaboration: We collaborate with climate organisations around campaigns.

- Policy recommendations: We provide direct feedback to institutions through public and private outreach.

Read our analysis and policy recommendations

Chemicals and CCS/U: Exploring the role of carbon capture in the sector’s transition to ‘circularity’

This technical brief explores the potential role of carbon capture, storage and utilisation (CCS/U) for Europe’s chemicals sector.

We find that CCS/U will be necessary in Europe’s chemicals sector, but only to a limited extent in targeted applications.

Steel labelling: Beyond the sliding scale

As EU policymakers debate how to certify low-carbon steel, Sandbag’s new briefing analyses the “sliding scale” method — and outlines why it may hinder rather than help decarbonisation. A new model is proposed based on product-specific benchmarks, multi-tier ratings, and circularity incentives.

Scrap Steel at Sea: How ship recycling can help decarbonise European steel production

As Europe seeks to decarbonise its steel industry, a new Sandbag report highlights an overlooked solution: high-quality scrap steel from retired ships. With up to 15 million tonnes of certified scrap available annually, ship recycling could meet 20% of EU steel scrap demand — if policy gaps are addressed.

Developing data tools

We develop data tools to analyse industrial emissions and to assess different technologies.

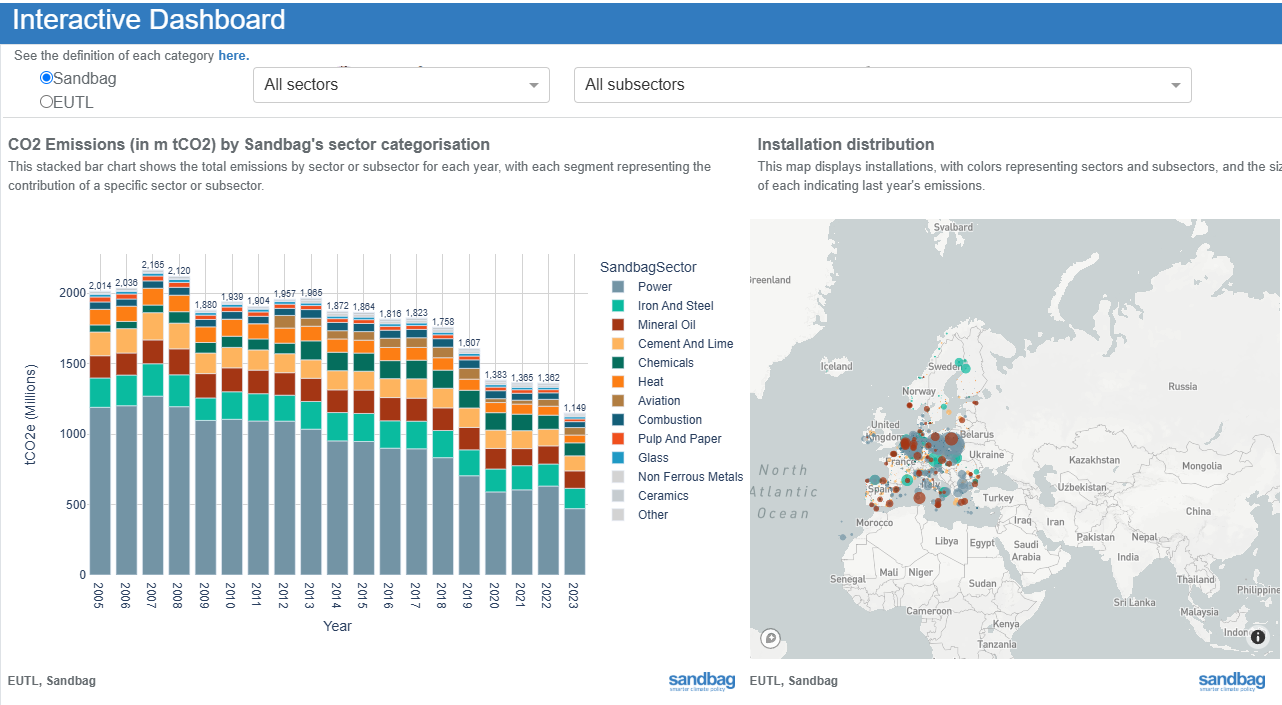

EU ETS Dashboard

Navigate emissions data of sectors covered by the EU ETS at various granularity levels.

Our messages

On steel

- Free allocation in the EU ETS should be phased out.

- Before this is done, free allocation should be done in equal amounts for a given type of product (long or flat) regardless of feedstock and production route

- Carbon Border Adjustment Mechanism (CBAM) should attribute embedded emissions to steel scrap to prevent circumvention.

On hydrogen

- Avoid unnecessary demand for green hydrogen in sectors with better alternatives.

- Distribute aid fairly across competing solutions, prioritising low-carbon, resource-efficient alternatives like recycling and organic fertilisers.v

- Reform EU criteria for green hydrogen to prevent overreliance on fossil fuels and price volatility.

Get involved and support us towards this effort!

We need to improve decarbonisation policies and develop solutions to achieve the EU’s net-zero targets by 2050.

WHAT WE DO

TOOLS

PUBLICATIONS

NEWSLETTER

Mundo-b Matogné. Rue d’Edimbourg 26, Ixelles 1050 Belgium.

Sandbag is a not-for-profit (ASBL) organisation registered in Belgium under the number 0707.935.890.

EU transparency register no. 277895137794-73.

VAT: BE0707935890.