Since its creation in 2005, the EU Emissions Trading System (ETS) has been in a near constant state of crisis and reform. Since 2011, the carbon price has remained below €10 a tonne, unable to significantly influence investment decisions, and failing to drive the most cost-effective emissions cuts.

The final trialogue discussions in the latest round of carbon market reform are now approaching: these give us one more chance to push towards policy which would support a meaningful European carbon price, and step up Europe’s efforts to tackle climate change.

For a meaningful carbon price before 2030, the trialogue discussions on September 13th must:

The rock-bottom carbon price (currently around €6) is not the only issue facing the ETS. Reforms should also:

- End ETS funding for coal power by bringing in a 450g/CO2/kWh limit on Article 10c and Modernisation Funds

As proposed by the European Parliament, this stops free allowances being used for investments in coal plants. A carbon intensity threshold for investments under the ETS would be in line with the 2013 European Investment Bank decision to stop investing in high-carbon power plants, and with the Commission’s proposed legislation to prevent capacity payments to high-carbon plants. To reach the “Below 2 degrees” goal agreed at Paris, IEA modelling shows there must be no unabated coal in Europe by 2030, so Central and Eastern Europe needs support to avoid lock-in over the next decade. Having a clear low-carbon investment criterion is more important for this purpose than disputes on governance of the funds.

- Maintain the share of allowances auctioned at 57% (as in the Commission proposal).

Sandbag research shows that Free Allocation to some high-emitting industry will actually increase in Phase IV, even as the need for carbon leakage protection lessens (as other jurisdictions develop carbon pricing). Industry is well protected and has nothing to fear from the current ETS reforms.

The persistent surplus

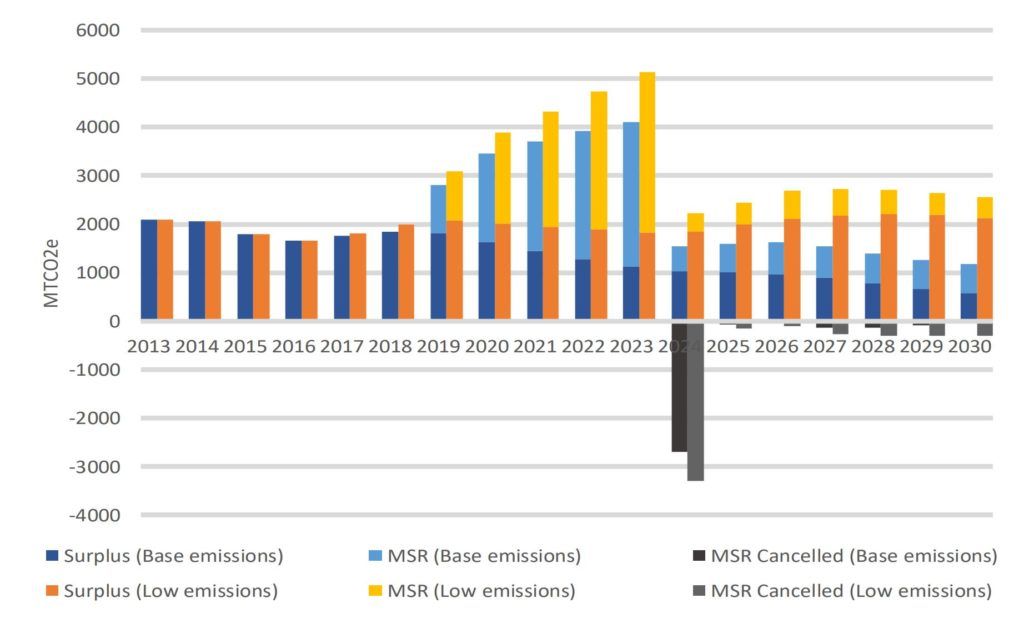

Even with the Council proposal, the ETS remains oversupplied by 1-2Bt in 2025, suggesting no change in the carbon price

As currently amended by the European Council, Sandbag has calculated that the reforms will leave the ETS with a market surplus of over 1Bt late into the 2020s, even in our conservative base case emissions scenario. In our low-case emissions scenario, the market surplus will remain over 2Bt even in 2030.

With market surpluses in the 2020s similar to today’s daunting size (1.7Bt) we would not expect to see a carbon price above €10. This isn’t good enough.

Recent reforms in California are showing how carbon pricing can work effectively, with prices above €12 and climbing. Meanwhile British Columbia’s €25 carbon tax is shortly to be expanded around Canada, and China is set to launch their own carbon market later in the year. It’s time for the EU to catch up, and start driving low-carbon innovation here.

Read more

Read more on our emissions forecast in Sandbag’s May briefing A tale of two surpluses

Read about our proposal for a five-yearly rebalancing mechanism in Sandbag’s June briefing: Creating a virtuous circle

Read more about why we need a Europe wide uniform legislation on investments in energy supply in our briefing on capacity markets: Capacity payments and 550g and check out Sharing the burden for why having a clear low-carbon investment criterion in legislation is more important than disputes on governance of the ETS low-carbon funds.