This new technical brief analyses how the EU’s Carbon Border Adjustment Mechanism (CBAM) is likely to affect fertiliser prices in 2026, with a detailed focus on urea and the role of EU price formation.

This brief builds on earlier Sandbag analysis showing that expected CBAM-related fertiliser price increases in the early years of implementation are limited.

France calls for exempting fertilisers from CBAM — Sandbag shows why this is the wrong approach

Estimates suggesting that the EU’s Carbon Border Adjustment Mechanism (CBAM) could increase fertiliser prices by up to 30% have brought a central question into focus: how significant is the inflationary impact likely to be? These projections of inflation have prompted member states to invoke a potential application to fertilisers of the proposed Article 27a, which would allow the European Commission to temporarily suspend CBAM obligations for specific goods “in the event of serious and unforeseen circumstances” causing significant market distortions.

In a recent analysis published on 7 January, Sandbag estimated that the price increase due to the inclusion of fertilisers in the CBAM should be small because it will be driven by the increased EU ETS costs faced by EU producers. Yet other projections anticipated that the impact will be much larger, considering calculations of CBAM costs for some importers, based on default values for products’ emission intensities published by the European Commission. These calculations are not incorrect, but they do not calculate the same thing: cost rather than price. Although the two are related, the impact on price depends on who bears which costs: importers or EU suppliers.

This note clarifies how this plays out for the case of one of the main nitrogenic fertilisers used in Europe: urea (CN code 310210). In the following, we assume an EU carbon price of €80 per tonne of CO₂-equivalent in 2026.

CBAM costs for importers

For importers, CBAM compliance costs are given by the following expression:

CBAM Cost ≈ (Embedded emissions – SEFA) × EU ETS price.

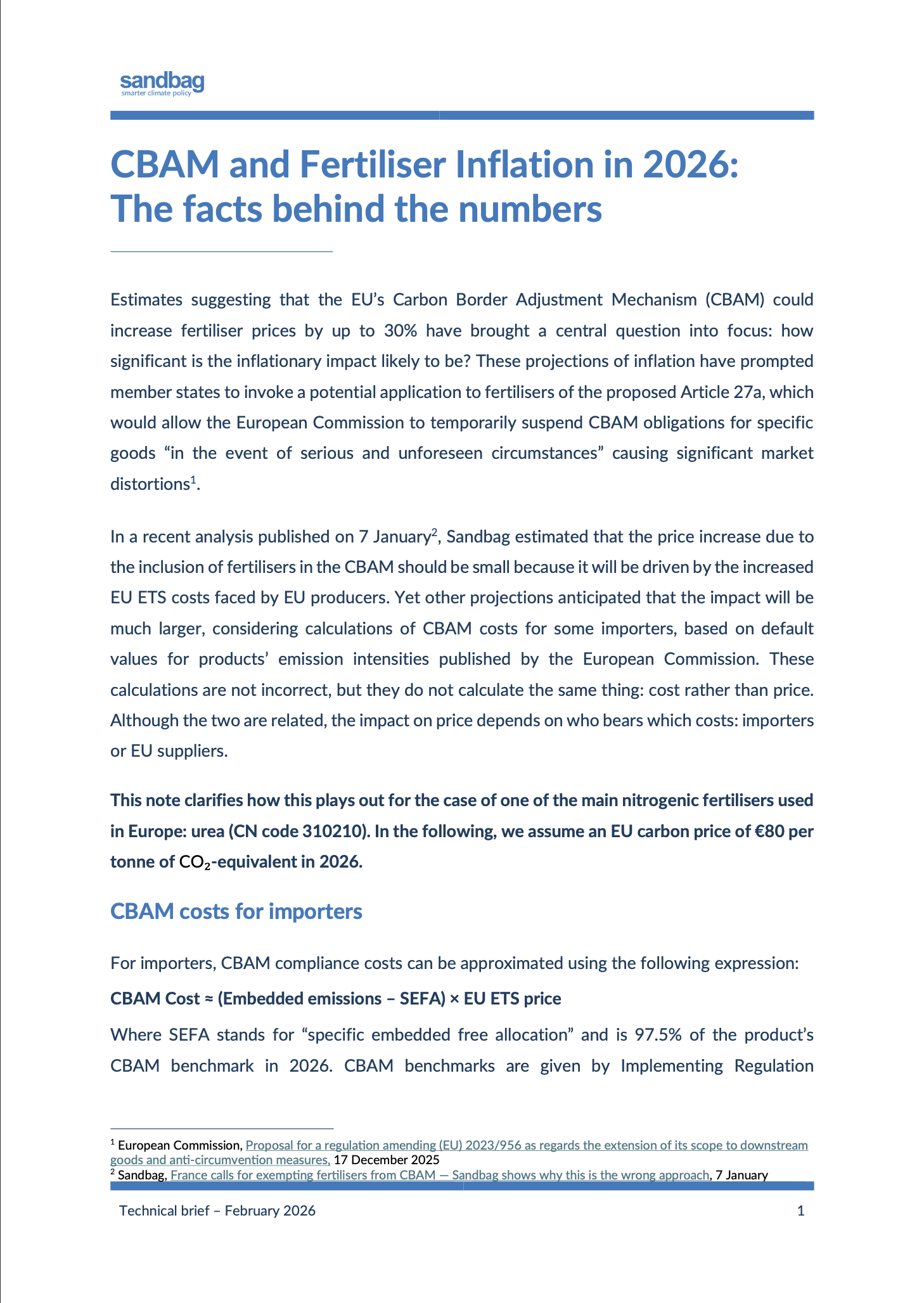

Where SEFA stands for “specific embedded free allocation” and is 97.5% of the product’s CBAM benchmark in 2026. CBAM benchmarks are given by Implementing Regulation. 2025/2620 and show for urea (Table 1) 0.902 t CO₂e if the CBAM charge is calculated using default values (column B) and 0.053 (column A) if using actual data.

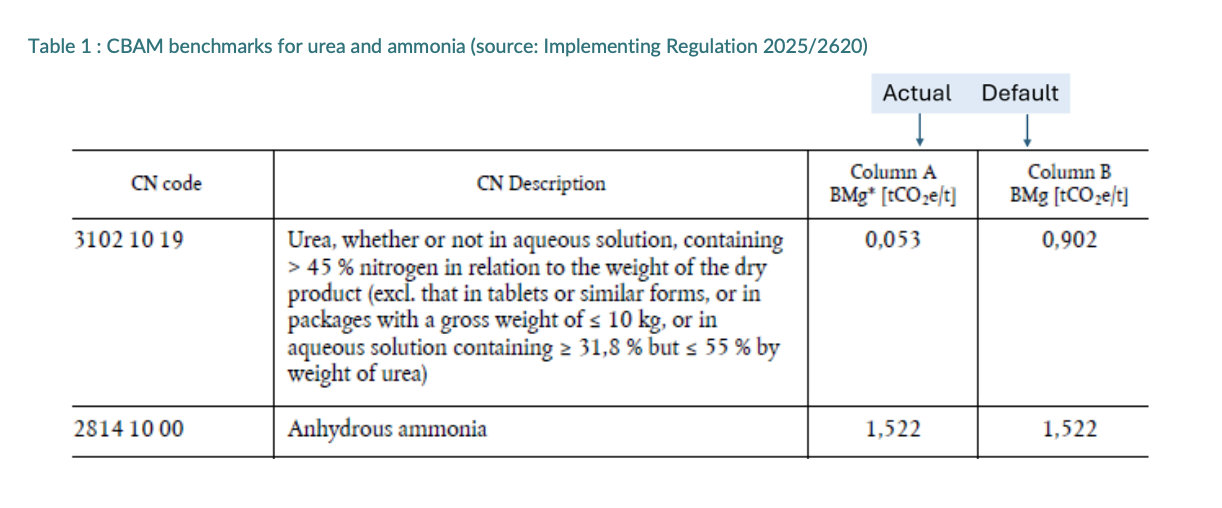

Default values are given by Implementing Regulation 2025/2621 for each country and each product.

Egypt is a useful reference point, accounting for around one-third of EU nitrogen fertiliser imports and being assigned a relatively high embedded-emissions factor of 1.404 t CO₂ per tonne of urea under CBAM default values.

For Egyptian urea, based on default values:

SEFA = 97.5% * CBAM benchmark (column B) for urea = 97.5% x 0.902.

CBAM cost = (1.404 – 97.5% * 0.902)) x 80 = 41,96€ per tonne of urea

The above is the cost for operators not providing actual data and therefore relying on conservative default values. These operators are likely to be outcompeted by those claiming CBAM fees based on actual data.

For Egyptian urea based on actual data.

The calculation for SEFA is: SEFA = 97.5% * (CBAM benchmark (column A) for urea

+ % of ammonia per t of urea4 x CBAM benchmark (column A) for ammonia)

= 97.5% x (0.053 + 57% × 1.522).

The resulting cost based on actual emissions is therefore:

CBAM cost = (actual urea emissions – 97.5% x (0.053 + 57% × 1.522)) × €80

According to a CBAM analysis prepared for the European Bank for Reconstruction and Development (EBRD) 5 , embedded emissions for urea produced in a typical integrated ammonia–urea plant in Egypt are estimated at approximately 1.1 tCO₂ per tonne of urea.

Thus, we can calculate CBAM cost as:

CBAM cost = (1.1 − 97.5% x (0.053 + 57% × 1.522)) × €80 = €16.19 per tonne of urea for average plants.

To estimate the emission intensity of higher-efficiency installations, we assume emissions 10% below the average level.

CBAM cost = (0.99 − 97.5% x (0.053 + 57% × 1.522)) × €80 = €7.39 per tonne of urea for more efficient plants.

The most polluting importers, as well as those declaring emissions based on default values, are likely to be outcompeted by more efficient ones claiming CBAM fees based on actual data. This is why the relevant CBAM cost for the EU market is more likely to be the latter, i.e. €7.4 per tonne of urea.

.

CBAM-linked ETS costs for EU Producers

The other important players in the EU fertilisers market are EU producers. For them, the incremental carbon cost is the number of free allowances removed as a consequence of the CBAM. In 2026, it corresponds to 2.5% of the free allowances that would otherwise be given without the CBAM, i.e. 57% of the ammonia benchmark (1.57 EUA per tonne of ammonia) tCO₂ per tonne:

ETS cost = 1.57 × 57% × 2.5% × €80 ≈ €1.79 per tonne of urea caused by the CBAM

.

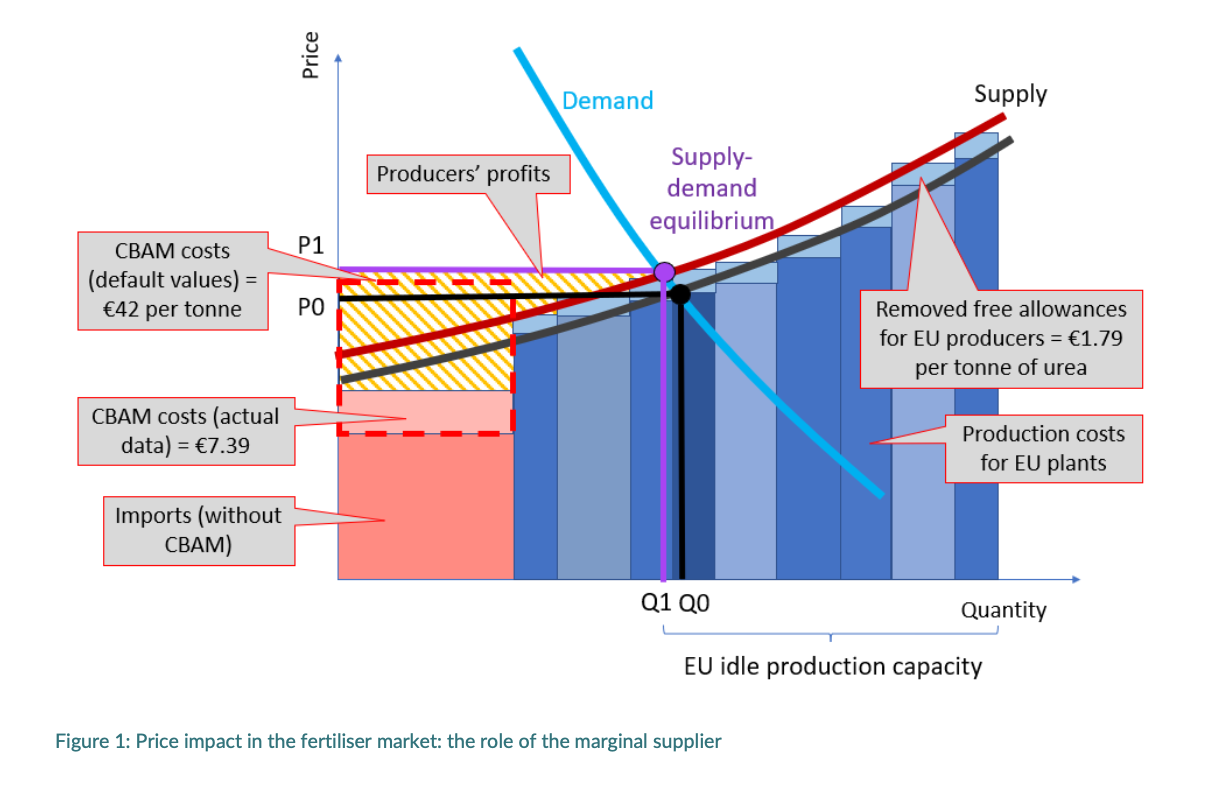

Which cost drives the price?

CBAM costs alone do not determine market prices. In competitive markets, prices are set by the marginal supplier, which is the plant producing at the smallest positive profit margin, represented in Figure 1 as the plant aligned with the black vertical line. The cost of that plant sets the market price P0, shown by the horizontal black line. Once the CBAM comes in, EU plants bear a small extra cost of €1.79 per tonne of urea, which is likely to drive the price up (as per the purple line).

On the contrary, cheaper imports (from countries with cheap natural gas and labour) are unlikely to drive prices up, because the addition of CBAM costs, even if they are higher than EU ETS extra costs, will probably not make the total cost of imports exceed that of the marginal EU plant. If EU producers, who already face EU ETS obligations and often operate with tighter margins, remain price-setting, fertiliser prices are more likely to be driven by domestic carbon costs than by CBAM-related costs on imports.

It is even possible that some fertilisers from other countries, with lower emissions than EU producers will bear lower CBAM costs than European ETS costs. Under this scenario, EU industry would pass through less than 100% of its incremental ETS costs to preserve competitiveness. Based on an 80% cost pass-through rate, the price effect of the CBAM would be limited to €1.4 per tonne of urea.

Photo by oticki from Getty Images.

In the news

- Carbon Pulse, 18 February 2026: January’s fertiliser drop linked to stockpiling, not the EU CBAM fee – trade bodies, NGOs.

- POLITICO, 26 January 2026: 12 EU countries ask Brussels to exempt fertilisers from carbon border tax.

Related Publications

Aug 25th 2025

Aug 6th 2025

Try the CBAM simulator yourself

More on the CBAM

The EU CBAM gives a boost to Algeria’s iron exports

Sandbag’s brief assesses how the EU Carbon Border Adjustment Mechanism (CBAM) may affect Algeria’s iron and steel exports. It finds that although Algeria’s overall exposure to CBAM is limited, rising EU carbon costs are likely to increase EU market prices, with implications for the revenues and competitiveness of Algerian exports.

The CBAM dividend for Namibia and Ghana

This research note shows that Namibia and Ghana are likely to benefit from the CBAM, as EU price increases linked to the EU ETS outweigh CBAM fees under current exports. It also sets out transparent transformation scenarios, based on announced industrial projects, to show how expanded and lower-emissions production could further increase export revenues over time.

Chemicals in the CBAM: Time to step up

Sandbag’s latest brief explains why the EU CBAM must be expanded to cover key chemical value chains. With chemicals and refinery products responsible for 30% of industry emissions, phased inclusion is critical to prevent carbon leakage and phase out free allowances.