Supply and demand in the EU ETS: It’s the hydrogen, stupid!

This note analyses the supply and demand balance of the EU ETS until 2030. It is based on Sandbag’s ETS Simulator, which was updated with the market’s latest data and policy parameters.

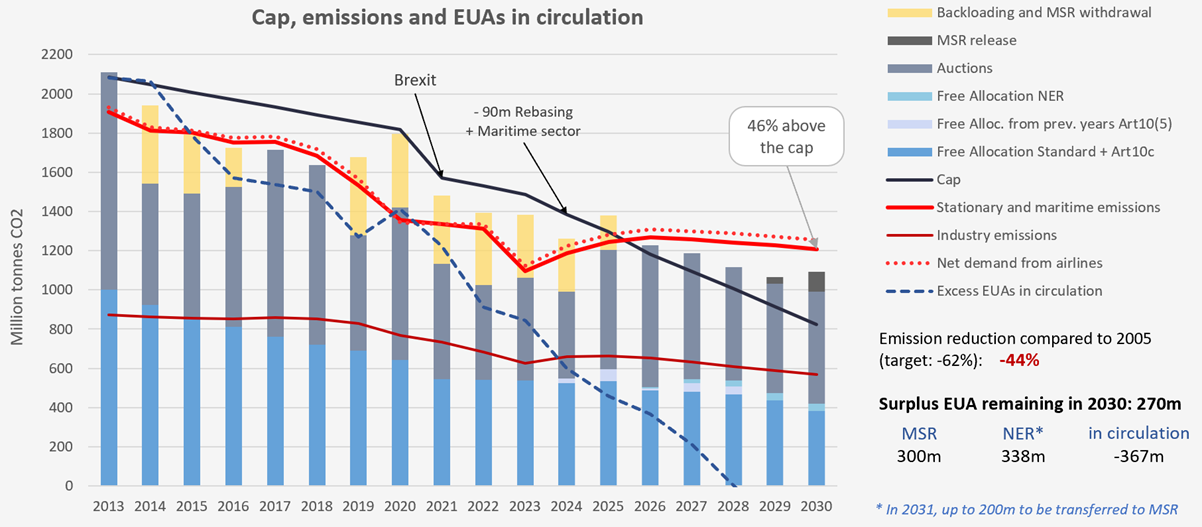

• The EU ETS is on track to end its fourth phase in 2030 with a comfortable surplus of 1.7 billion emission allowances, of which 900 million will be kept locked up in various reserves.

• This is due to sluggish electricity production, which makes the current rate of renewables capacity increase sufficient to keep decarbonising the power sector.

• However, this scenario is incompatible with the deeper decarbonisation of the economy needed to meet the EU’s 55% emission reduction target, which would require a boost in electrification.

• In the European Commission’s MIX energy scenario in line with the bloc’s emission target, the market’s surplus at the end of 2030 could be reduced to less than 1.1 billion allowances, of which only a fifth would be in circulation.

• The balance could all change once hydrogen production comes into play. In a high scenario in line with the EU’s REPowerEU plan, the surplus could be completely wiped out, with even a deficit of up to 400m allowances in circulation, despite over 600 million being locked up in reserves.

A comfortable surplus

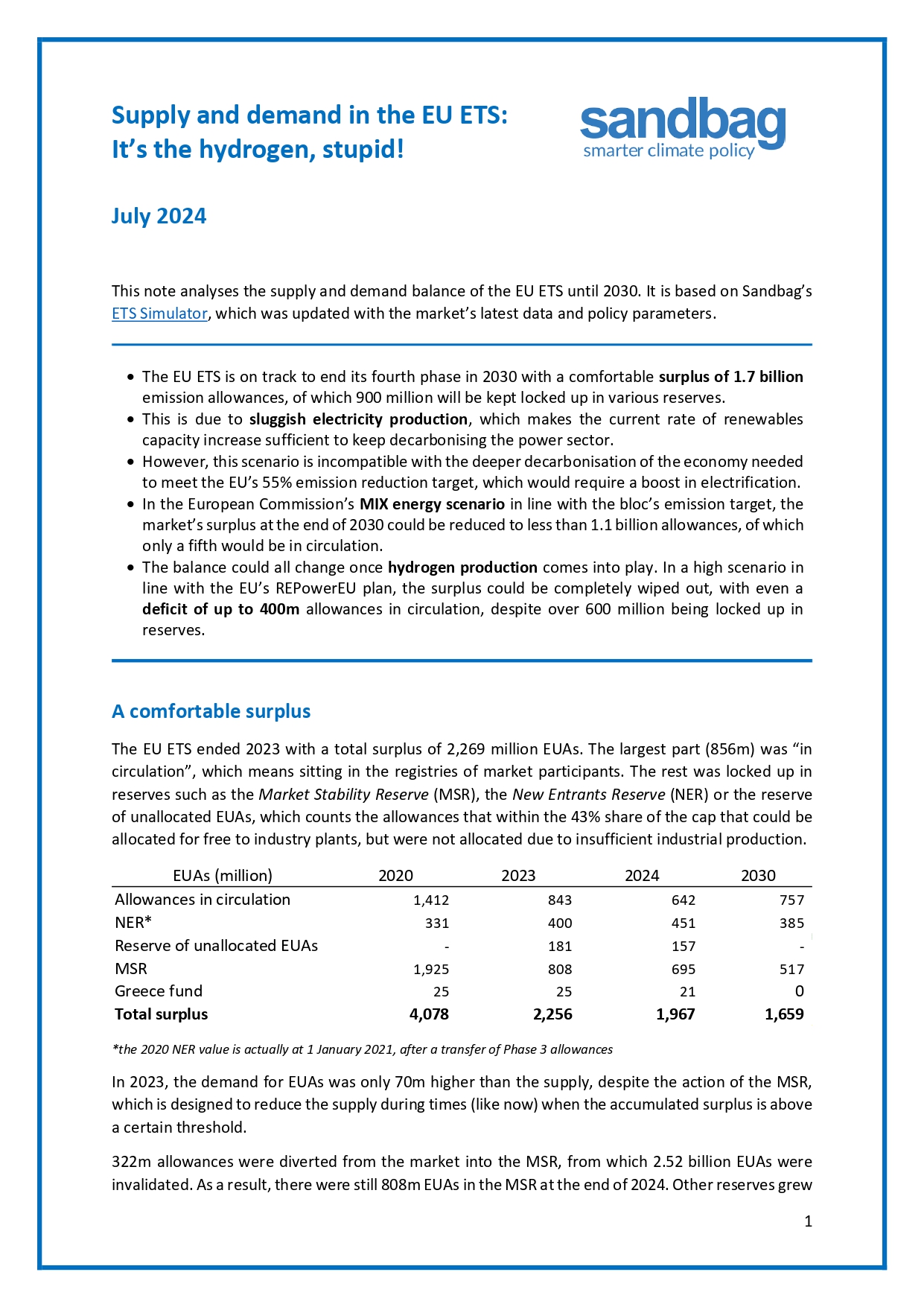

The EU ETS ended 2023 with a total surplus of 2,269 million EUAs. The largest part (856m) was “in circulation”, which means sitting in the registries of market participants. The rest was locked up in reserves such as the Market Stability Reserve (MSR), the New Entrants Reserve (NER) or the reserve of unallocated EUAs, which counts the allowances that within the 43% share of the cap that could be allocated for free to industry plants, but were not allocated due to insufficient industrial production.

*the 2020 NER value is actually at 1 January 2021, after a transfer of Phase 3 allowances

In 2023, the demand for EUAs was only 70m higher than the supply, despite the action of the MSR, which is designed to reduce the supply during times (like now) when the accumulated surplus is above a certain threshold.

322m allowances were diverted from the market into the MSR, from which 2.52 billion EUAs were invalidated. As a result, there were still 808m EUAs in the MSR at the end of 2024. Other reserves grew as well, with the NER taking in 70m EUAs due to low industrial output over 2021-22 (the NER grows when output falls below five-year output average levels) and overall free allocation was way below the limit of 43% of the cap which added 42 million to the number EUAs available for allocation in the following year, as per Article 10a(5) of the EU ETS, to 181 million.

Over the period to 2030, this situation is likely to continue, as emissions will remain below the market’s cap, and the MSR won’t wipe out enough allowances to create scarcity.

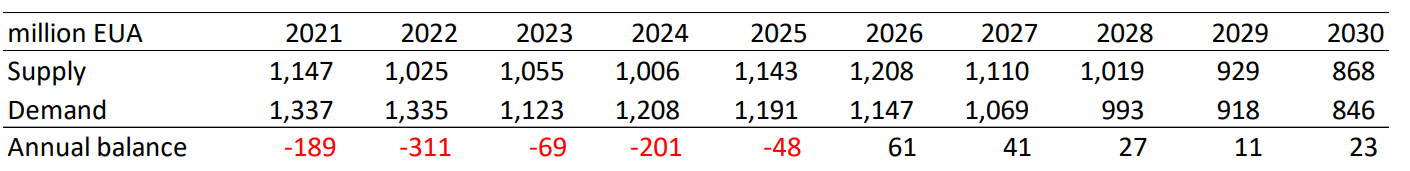

Sensitive to electricity

However, the situation is quite sensitive to assumptions on electricity production. The above scenario assumes stable electricity generation of 2,786 TWh for the EU27 over 2024-30, which is the average over the period 2020-23 (in 2023, generation was actually lower, at 2,693 TWh). It also assumes that the installed capacity of renewable energy sources (RES) will increase at the rate of 39 GW per year, which is also the average observed over 2020-23.

Emissions from the power sector continue to decrease, while the European industry implements “gentle” reduction measures such as the replacement of some blast furnaces with electric arc furnaces in the steel sector (only the projects already announced), fuelled by natural gas. In the cement industry, more clinker is replaced with alternative binders.

Supply and demand in the “current trend” energy scenario

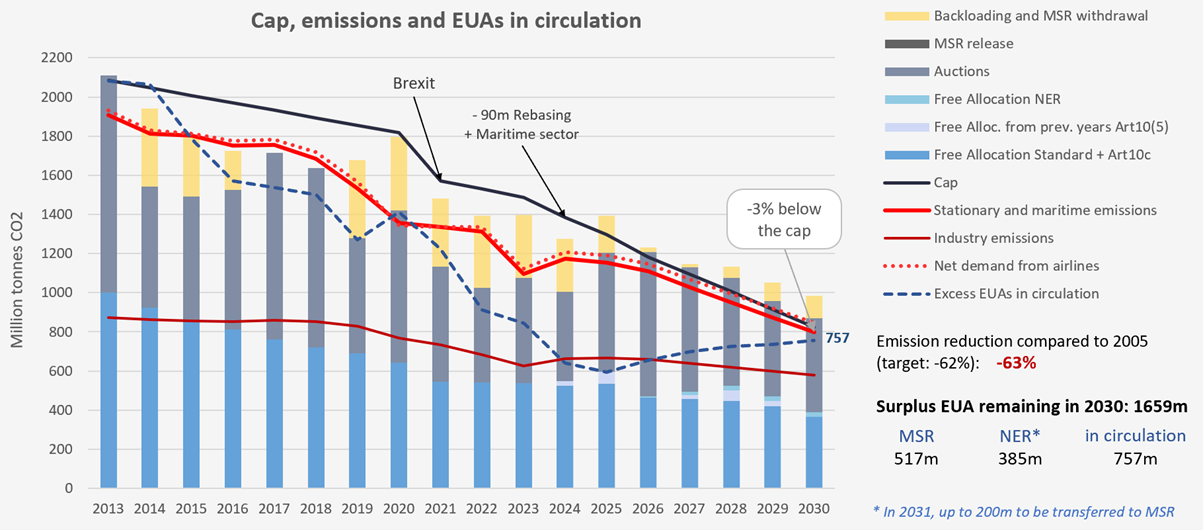

This scenario is a far cry from the MIX scenario presented by the European Commission to comply with the EU’s 55% emission reduction target. The MIX scenario would require electricity generation to climb up to 3,153 TWh by 2030 in order to electrify sectors such as transport and heating, and RES capacity installation to accelerate to 57 GW annually over 2024-30.

The MIX scenario

It is one of the policy scenarios developed by the European Commission in an Impact Assessment published in [2020] as part of the Fit-for-55 package. This scenario is qualified as “core” in the assessment, alongside two others (REG and MIX-CP) which all aim to achieve 55% emissions reduction by 2030. Detailed energy output results are provided by sector, based on the PRIMES model. [1]

Of the three core scenarios, MIX is the most aligned with reality, as it assumes buildings and road transport are covered by carbon pricing (unlike REG), and there are “strong energy and transport policies”, unlike MIX-CP.

There are minor differences between MIX and reality: for example, MIX assumes that the share of renewable energy sources in the EU’s gross final energy consumption will reach approximately 40% by 2030, which is slightly less than the Renewable Energy Directive’s objective of 42.5%. But MIX has extra EU aviation covered, which is not reality and compensates somehow the less stringent renewables objective.

In the scenario where electricity generation catches up with the EC’s MIX scenario, which we took as reference in previous analyses, the EUA surplus would shrink to around 1 billion as the RES installation rate would be outpaced by increased electricity use, which would result in more thermal electricity generation, even though emissions would be reduced in other sectors such as transport and heating not covered by the EU ETS.

Exact numbers depend on other factors, such as the free allocation benchmarks which will determine the number of EUAs given for free to industry plants per tonne of output in 2026-30, and the growth of industrial activity which impacts both emissions and free allocation. In a scenario of high benchmarks and high growth, the surplus could shrink to 984m including 236m in circulation, whereas in a scenario of low benchmarks and low growth, it would be 1,086m EUAs including 301m in circulation.

While the “current trend” scenario would keep emission below the ETS cap, the “MIX catchup” scenario would see emissions exceed it by up to 25%.

Free Allocation Benchmarks

Benchmarks represent the number of allowances given for free to EU factories per unit of output. They are based on the emission intensity of the 10% most efficient EU installations for given products or processes, measured at different times. For example, the benchmarks applicable in 2021-25 are based on emission intensity measurements collected by the Commission in 2016/17, and those applicable in 2026-30 will be based on measurements made in 2022/23. Those have not yet been published, so we created two cases: a ‘low benchmarks’ case where the emission intensity of the 10% best plants keep decreasing at the same speed as it did over 2007-17, and a ‘high benchmarks’ case where their emission intensity stops decreasing after 2017.

Supply and demand in the “MIX catchup” energy scenario

The hydrogen problem

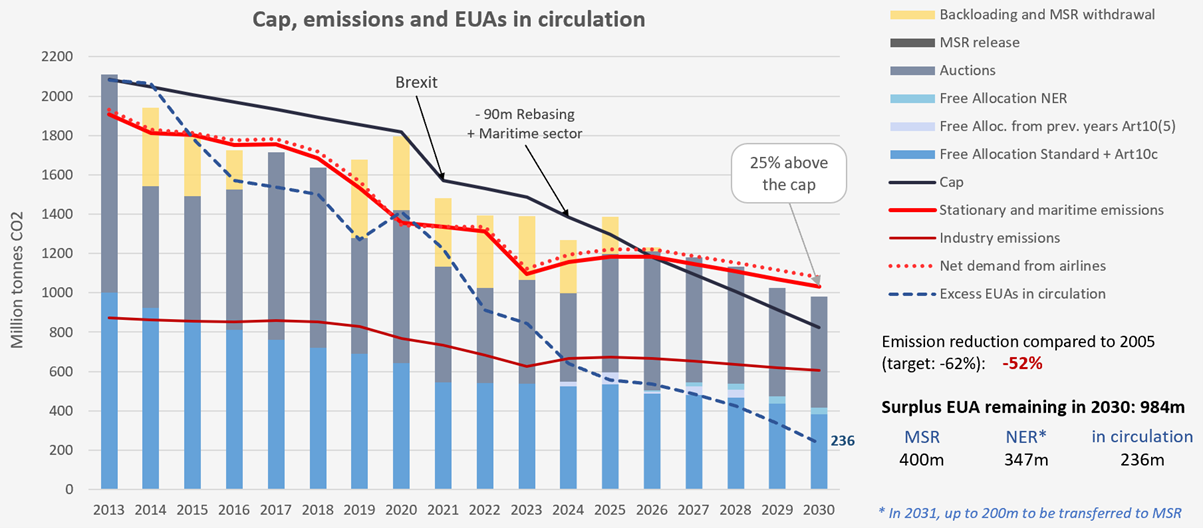

The above “current trend” and “MIX catchup” energy scenarios don’t assume any role for “green” hydrogen. In the last couple of years, a large number of policies were set up to encourage the production and use of hydrogen from water electrolysis: the Renewable Energy Directive, the ReFuelEU aviation regulation, the FuelEU maritime regulation, the European Hydrogen Bank, the inclusion of all hydrogen production under the EU ETS, the Free Allocation Regulation, the Innovation Fund, the REPowerEU plan, as well as national subsidy schemes governed by the Important Projects of Common European Interest (IPCEI) scheme.

Hydrogen can be used as replacement feedstock to fossil fuels in many applications but consumes a lot of electricity. We have therefore created 3 hydrogen scenarios in which “green” hydrogen plays different roles. In this analysis, we use the term “green” to qualify hydrogen produced from water electrolysis, regardless of the type of electricity used.

In the No scenario, no “green” hydrogen is produced. The RED scenario consists of meeting the objectives set by the Renewable Energy Directive in the industry and transport sectors, which corresponds to about 5 million tonnes of hydrogen production in Europe. Emissions are reduced at steel and fertiliser plants and oil refineries, but they increase at power plants, with an overall positive net balance.

If combined with the MIX catchup energy scenario, the RED hydrogen scenario results in a net increase of EU ETS emissions and a reduction in the EUA surplus down to 8-900m, of which less than 75m are available.

The REPowerEU scenario uses the EU’s assumption that “green” hydrogen production will reach 10 million tonnes annually in the bloc by 2030. Compared to the RED scenario, this one creates a lot more demand for electricity but does not reduce more emissions within the EU ETS scope, as the end-use sectors for this hydrogen are assumed not to be heavy industry or power generation.

This scenario creates real scarcity in emission allowances, with some surplus still locked up in reserves but a shortage of EUA in circulation of up to 370 million.

Supply and demand in the “RePowerEU” hydrogen scenario

Such scenario should result in rising carbon prices and electricity prices, leading to a drop in demand and a return to a balanced market. However, the accumulation of subsidies to industry (in the form of free emission permits), hydrogen production (in the forms listed above) and electricity use (in the form of “state aid compensation for indirect carbon cost” under the EU ETS) might dampen these natural market brakes and send the carbon price to stratospheric levels before it has any mitigating effect on the demand.

This scenario might also have policy implications. As emissions start to consistently exceed the cap, politicians might get tempted to recalibrate the cap at a higher level for the next phase starting in 2031, which might seal the end of Europe’s carbon neutrality goals.

Energy and hydrogen are key elements to the success of “Fit-for-55”. They also have a big influence on the EU’s carbon market. Policymakers should keep this in mind before handing out subsidies.