Emissions covered by the EU’s Emissions Trading Scheme rebound but allowances in circulation remain as high as in 2019

This analysis is based on estimations using data available as of 4 April 2022. It will be updated as more data is made available during the coming weeks.

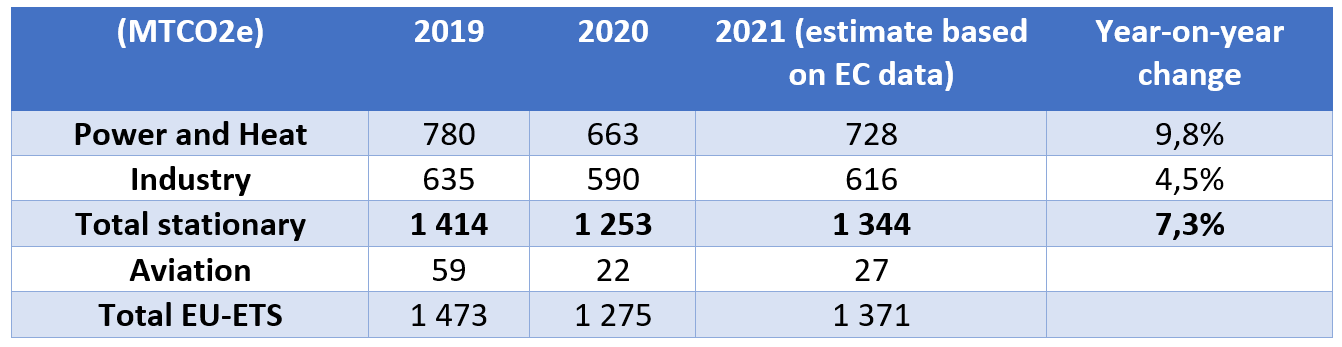

The European Commission has released the bulk of its data on reported emissions from EU ETS sectors for the year 2021. Emissions from stationary installations in 2021 were 1,344 MT, an increase of 7.3% compared to 2020, and 14% below the ETS cap, according to estimates from Sandbag.

After a significant drop in emissions in 2020 caused by the Covid-19 pandemic, emissions were expected to rise again in 2021 as production resumed. We had foreseen an increase of 6.2% of stationary emissions, slightly below the more likely increase of 7.3%. The iron and steel sector shows the largest year-on-year growth in emissions (+13,7%), followed by the Power and Heat sector (+9.8%).

It should be noted that emissions data is not yet available for around 10% of stationary installations. Reported emissions were 1,259 MT and we estimate unreported emissions to be 84 MT, following the methodology explained last year here. This total of 1,344 MT is 14% below the ETS cap for stationary installations for 2021. Stationary emissions were still 5% lower than their pre-Covid level in 2019, with higher reductions in the power sector (-7%) than in the industry sector (-3%).

Emissions from the aviation sector cannot be directly compared to reported emissions from 2020 due to the change of scope following Brexit (emissions from flights within the UK and from the UK to the EU30 are now covered by the UK ETS). We now estimate that emissions from the aviation sector were 27,2 MT.

Total estimated EU ETS emissions for 2021 amount to 1,371 MT. According to our model, this contributed to a surplus of 1,213m allowances (the surplus is the number of allowances available in excess of demand for covering emissions after removals by the Market Stability Reserve). This is only 9m less than at the end of 2019 (1,222m), which means that the MSR barely removed enough allowances in 2020 and 2021 to stabilise the surplus but not reduce it. More worryingly, the MSR will stop reducing the surplus once it reaches the still very high upper threshold of 833m.

This huge surplus is bad news for climate action and must be addressed in the discussions around the EU ETS revisions of the Fit For 55 package. The large surplus means that, as the ETS cap is tightened in line with the EU’s new 2030 climate target, emissions will be able to exceed the cap in future years, by up to 40% if the revision proposed by the European Commission went through, according to simulations we made available online. In this way, the surplus undermines the EU’s climate ambition. It should be neutralised by:

- lowering the upper and lower MSR thresholds to 100 million EUAs and zero respectively;

- preventing the net release of allowances from the ETS reserves (MSR, New Entrants Reserve, unallocated allowances from previous years and the remaining allowances from Phase III made available to Greece) when emissions from a given year exceed the cap.

The estimated emissions from the industry also need to be put into perspective in terms of the amount of free allowances received by these installations. According to the latest data, 571 MT of allowances were given for free in 2021 (including a small share to the Power and Heat sector, e.g. to district heating installations), covering 88% of industry’s 2021 emissions. However, free allocation is a major obstacle to industrial decarbonisation and to the well-functioning of the EU’s carbon market.

Our proposed amendments and corresponding policy suggestions to the Commission’s proposal for an EU ETS Revision are available here.

Notes

[1] Sandbag is a non-profit think tank which uses data analysis to build evidence-based climate policy.

[2] For details on the data and methodology used for these estimates, please look at our methodology note from previous year.

Photo by Maxim Tolchinskiy on Unsplash