This brief shows that while the overall impact of CBAM is limited for Algeria, higher EU market prices driven by rising carbon costs could mean higher revenues for Algerian exports.

On 16 and 17 February, Sandbag contributed to a conference in Algiers hosted by the German development agency GIZ and the Algerian Ministry of Hydrocarbons and Mines. The conference brought together stakeholders from both sides of the Mediterranean including DG TAXUD, DG CLIMA and the EU’s Algerian representation, as well as a large number of delegates from several Algerian ministries and state-owned and privately own industrial conglomerates. Stakeholders shared information and discussed issues in relation to the scheme’s implementation, including procedures and methodologies of emissions monitoring, reporting and verification, as well as sector specific impacts of the CBAM.

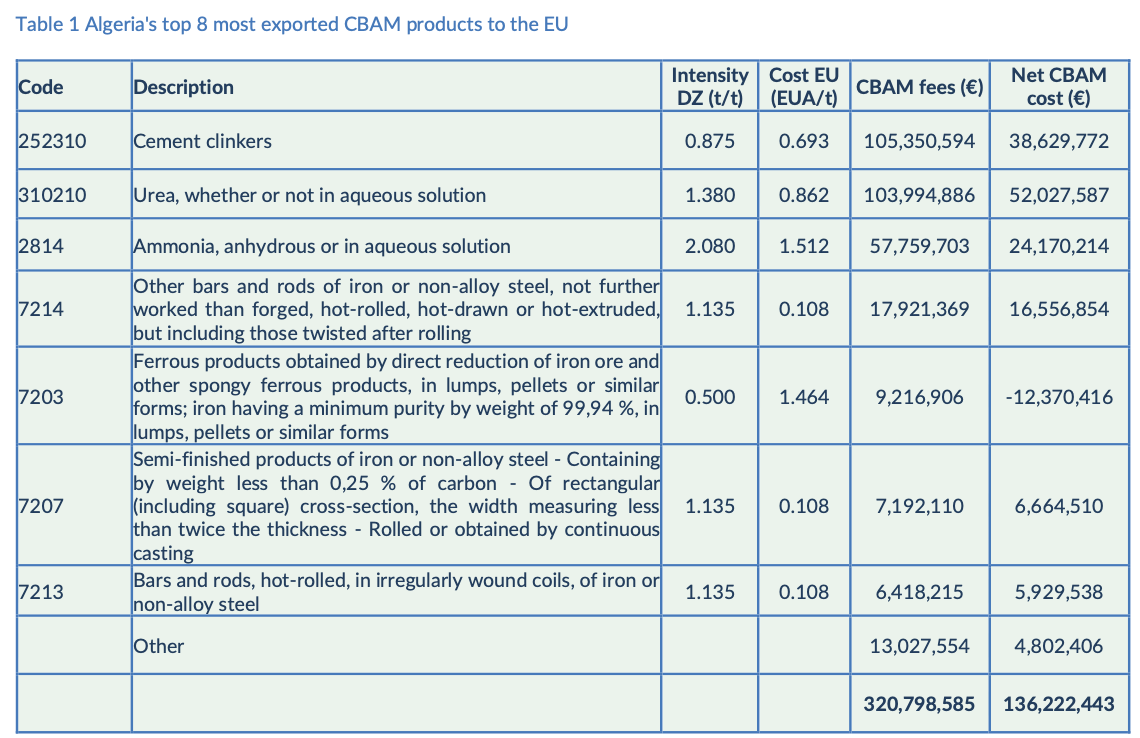

The overall impact of CBAM is very limited for Algeria, as CBAM goods only cover 2.7% of the country’s exports to the EU. We estimated that the scheme’s net cost for Algerian goods would, in total, be only about €136 million per year in a business-as-usual scenario based on 2024 export figures. Yet, some sectors will be more imacted than others, and Algerian stakeholders expressed some anxiety about the scheme.

The effect of CBAM on iron and steel

During the conference, we held a workshop on the potential impact of CBAM for Algeria’s iron and steel exports to the EU. In 2024, Algeria exported about 350,000 tonnes of long steel products to the EU, such as rebar (CN codes 7203 and 7214) and semi-finished products for construction (7207), but also 230,000 tonnes of direct reduced iron (DRI, with code 7203).

The CBAM will raise the cost of Algeria’s imports but also the selling price of those products in the EU market, as the phasing out of free emission permits in the EU ETS will force EU producers to pass their higher carbon costs through to consumers. Higher EU market prices mean higher revenues for Algerian exports.

Based on Sandbag’s estimates: For exports of long steel goods, the net CBAM cost (calculated as CBAM fees minus increased revenue from higher selling prices) will be positive by 29 million euros, making these products rather uncompetitive in the EU market. By contrast, exports of DRI will enjoy a significant increase in revenues, as EU blast furnaces face increasingly expensive carbon costs which will push the market price up by €94 per tonne. Since Algerian DRI has much lower emissions than European pig iron, which currently receives a large number of free allowances, the CBAM should create a net profit of €54 per tonne of DRI, and €12 million for the 350kt. The country has already raised its production capacity with investments from Turkiye’s Tosyali and Qatar’s AQS for increases of about 5 million tonnes in yearly DRI output.

A scenario in which Algeria would replace its current 350kt annual long steel exports with 350kt DRI exports to the EU would turn a €29m net loss into a €19m net gain for the country. These numbers are based on the assumption of a European allowance price of €80 and a pass-through rate of 80%. Methodological details are available on Sandbag’s CBAM Simulator webpage. We will soon update the Simulator to include a forward-looking transformation scenario.

We presented these figures at the conference in a workshop we conducted on iron and steel, which was very well received by the audience of Algerian steelmakers and government officials.

Image credit: GIZ Algeria

Related Publications

December 24th 2025

October 14th 2025

August 25th 2026

More on the CBAM

CBAM extension: Closing the emissions gap

Free allocation has long been used to address carbon leakage under the EU ETS, but it has key limitations. It only covers emissions up to benchmark levels, fails to reward cleaner EU producers, and forfeits auction revenues that could support decarbonisation. It also creates perverse incentives by making high-emission goods artificially cheap.

For a systematic use of default values in the CBAM

The current carbon emissions reporting in the CBAM fails to achieve its goal of replacing free allocations under the EU ETS and undermines its integrity. A systematic default value system would improve the CBAM and safeguard the EU ETS.

CBAM DRI loophole requires new free allocation reform

We took part in a targeted survey run by the European Commission’s DG TAXUD on methodologies used to calculate embedded emissions and the rules for adjusting CBAM obligations alongside free allocation under the ETS. Our proposal: free allocation should be reformed to close the ‘DRI loophole’.