This research note shows that both Namibia and Ghana are likely to benefit from the CBAM, as EU price increases outweigh CBAM costs under current exports. It also sets out transparent transformation scenarios based on announced industrial projects, to illustrate how export revenues could increase further as production expands.

A new case for African exporters under CBAM

The Carbon Border Adjustment Mechanism (CBAM) is often seen as a challenge for developing countries — a policy that risks penalising exports to Europe with new carbon costs. In a research note in October based on Sandbag’s CBAM Simulator, we wrote that the CBAM’s impact on African countries would be small and even positive for the aluminium sector. The note concluded that African exporters could largely avoid CBAM costs through relatively modest production changes and that, by adopting more sustainable value chains, the continent is well positioned to capture the benefits of the EU ETS phase-out of free allocation through higher EU market prices

The scenarios considered in that research note were all “backward-looking”, in the sense that they were based on the amount of goods exported by countries to the EU in 2023, without assuming any transformation of their industry. In our most recent research, we have modelled the CBAM’s impact on Namibia and Ghana in a more transformative scenario, based on development plans announced by those countries.

Our results show that with those investments made, these countries could significantly benefit from the CBAM — drawing new financial resources from the EU policy.

Profit comes from the expected higher prices imports will sell at in European markets, once the CBAM is implemented. As EU producers face higher costs with the phasing out of free allocation in the EU ETS for CBAM goods, the market price of CBAM goods in Europe will necessarily increase to pass these costs through to customers. The price increase will not only compensate costs for EU-made goods but benefit imports as well.

The modelling distinguishes between the current CBAM scope and its possible future extension to indirect emissions (from the use of electricity in the manufacturing of CBAM goods), which particularly affects electricity-intensive products like aluminium.

Unless otherwise stated, all figures and tables are based on Sandbag’s CBAM modelling.

Namibia: CBAM-financed hydrogen

Namibia’s exposure to the EU Carbon Border Adjustment Mechanism (CBAM) in 2023 was extremely small. Exports of steel and aluminium to the EU amounted to only a few tonnes, which would be liable to CBAM fees of roughly €3k and total net costs under €1k after full implementation of the CBAM, as shown in Table 1.

Although exports to the EU are currently negligible, there are plans to increase them, based on two flagship hydrogen-based projects.

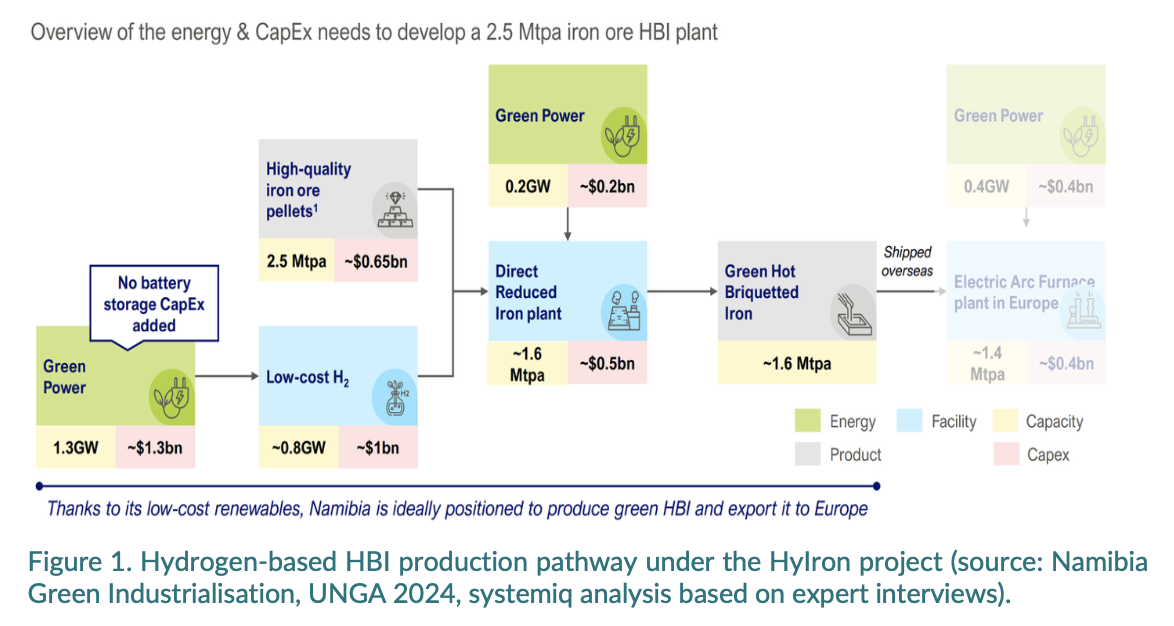

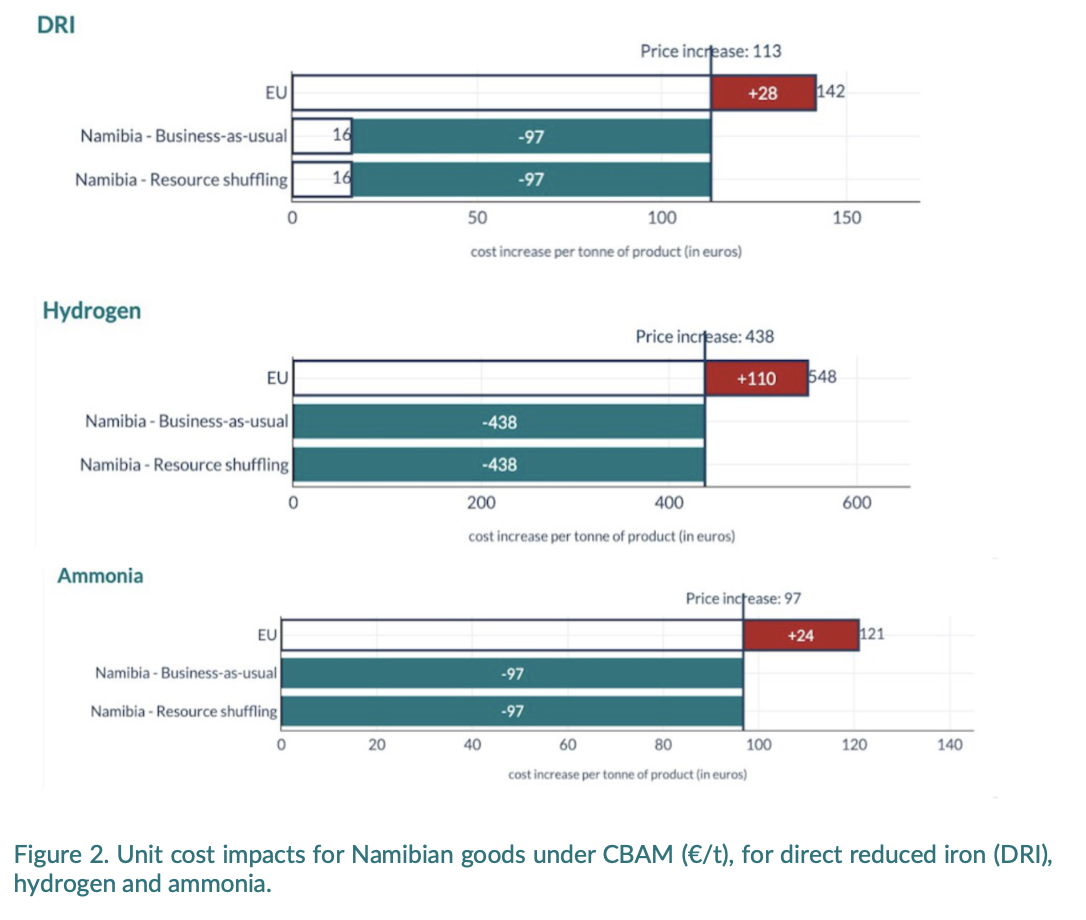

The Hylron project, developed with support from the EU and the German government in the Namib desert, began in April 2024, and hydrogen production commenced in March 2025. Having already begun producing around 15 kt of “green iron” since 2025, the project aims to scale up production capacity of up to 1.6 Mt of hot briquetted iron (HBI) per year. Because hydrogen will be produced from electricity, therefore without direct emissions, the CBAM liability will be close to zero. Thanks to an expected price increase of +€113 per tonne of ore-based metallics such as HBI in Europe, as illustrated in Figure 3, the phase out of free allocation in the EU ETS should result in a net positive balance for exports from this project.

The Hyphen project is a green hydrogen development company established specifically to develop large-scale hydrogen projects in Namibia. Under its current development plans, the project targets the deployment of around 300 kt of hydrogen per year by 2028–2030, which could be transformed into approximately 1.7 mt of ammonia annually.

Under current CBAM methodologies, both hydrogen and ammonia produced via water electrolysis have no direct process emissions, resulting in zero CBAM fees. At the same time, EU price effects linked to the EU ETS are expected to increase prices by around €438/t for hydrogen and €97/t for ammonia. Together, these results illustrate Namibia’s potential to benefit from the CBAM under a hydrogen-based industrial development pathway.

It should be noted that, for these products, there is no risk of circumvention or change of rules to prevent circumvention, which is illustrated by identical values in our “resource shuffling” scenario.

If indirect emissions were included in the CBAM (assuming constant power grid emissions of 64 kgCO₂/MWh), CBAM fees would increase marginally for HBI exports, by €2/t, but revenues would increase by €19/t due to the phase out of indirect cost compensation in the ETS which is expected to occur in parallel.

For hydrogen and ammonia, the CBAM’s impact is dominated by revenues rather than charges: EU prices increase by around €110/t for hydrogen and €24/t for ammonia, while CBAM-related costs remain comparatively small, leaving Namibia as a net beneficiary in both cases.

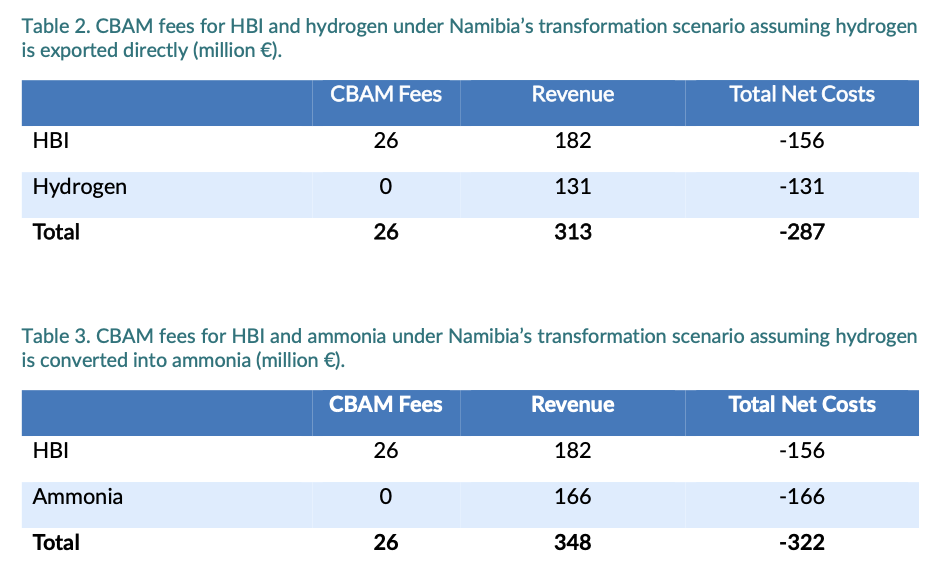

Aggregate impact

Aggregating CBAM costs and revenues from exported output from both projects, CBAM fees remain very low, at around €26 million across all products. At the same time, revenue increases by €287 million if the hydrogen is exported directly or by €322 million if it is transformed into ammonia before being exported.

The CBAM’s impact on Namibia’s development projects would be very positive, thanks to very low CBAM fees and CBAM goods selling at substantially higher prices in the EU. The CBAM would in effect support investment in those projects. Extension of the CBAM to cover indirect emissions would have no extra impact if Namibia’s hydrogen is produced from renewable electricity.

Ghana: A CBAM winner?

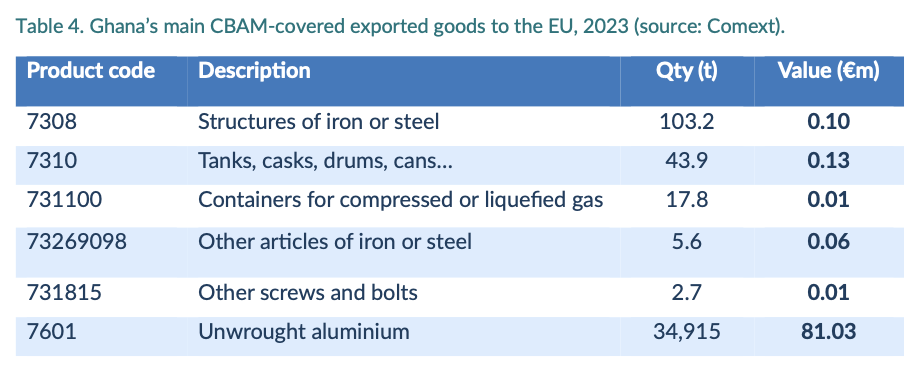

Ghana’s exposure to the EU Carbon Border Adjustment Mechanism (CBAM) is highly concentrated and overwhelmingly shaped by a single product: unwrought aluminium. In 2023, aluminium exports to the EU amounted to around €81 million, while CBAM-covered steel exports (the second largest CBAM-covered exports) were much smaller, at approximately €0.3 million.

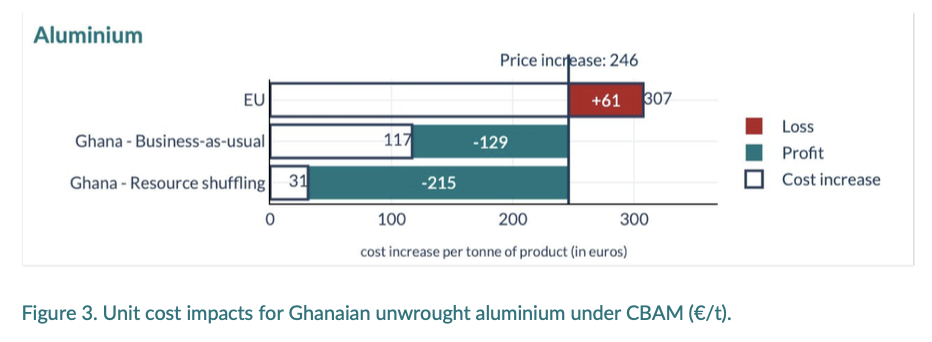

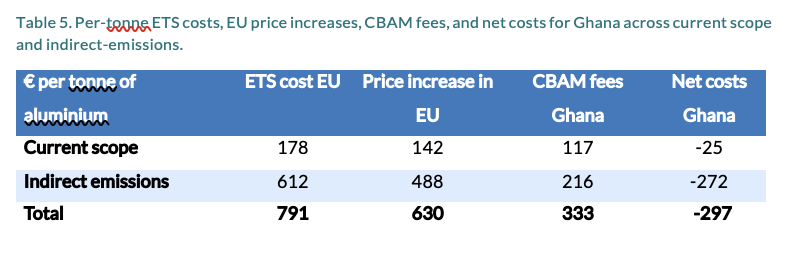

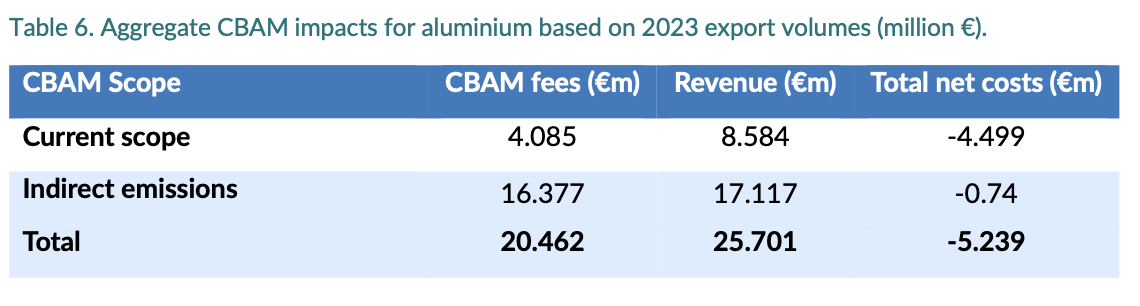

Without indirect emissions in the CBAM, Ghanaian aluminium exports face CBAM fees of around €117/t, while benefitting from EU price increases of around €142/t, resulting in a net positive gain of €25 per tonne. When including indirect emissions, Ghanaian exports become liable of €333/t in CBAM fees but earn €630/t in price premiums — a net gain of €297/t. The aggregate CBAM impacts under the current scope and if indirect emissions were included are shown in Table 6. (source: Sandbag calculations). Based on 2023 trade volumes and the current CBAM scope, importers of Ghanaian products would face roughly €4 million in CBAM fees. At the same time, the EU ETS pass-through raises EU aluminium prices by a larger amount, leaving Ghana with a net gain of about €4 million. When indirect emissions are modelled using Ghana’s electricity-grid mix (59% gas, 38% hydro, small oil/solar share), aluminium-related CBAM fees rise to around €20 million, but Ghanaian exports still record a net gain of approximately €5 million.

Going forward: more gain through more exports

The figures shown in the previous section were “backward-looking”, in the sense that they were based on the amount of goods exported by countries to the EU in 2023. Here we have modelled a more transformative scenario, based on development plans announced by different sources.

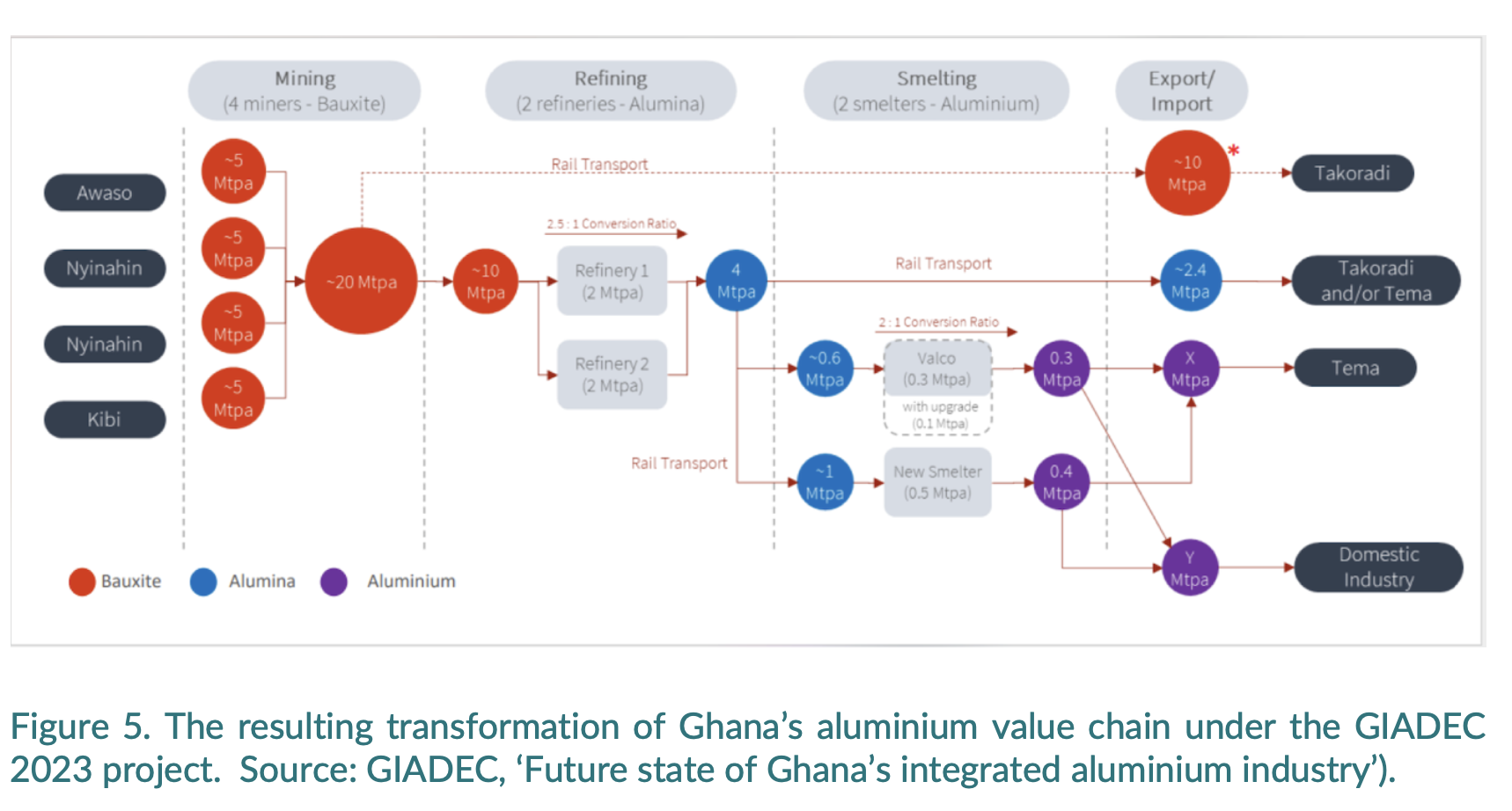

Under the Ghana Integrated Aluminium Development Corporation (GIADEC) project, domestic refining and smelting capacity is expected to expand significantly. In particular, aluminium smelting capacity is assumed to increase from approximately 200 kt to 800 kt, supported by the development of new refineries and smelters.

The modelling assumes that neither emission intensity of aluminium production nor of the electricity grid will change, so the bottom line is only affected by changes in export volumes.

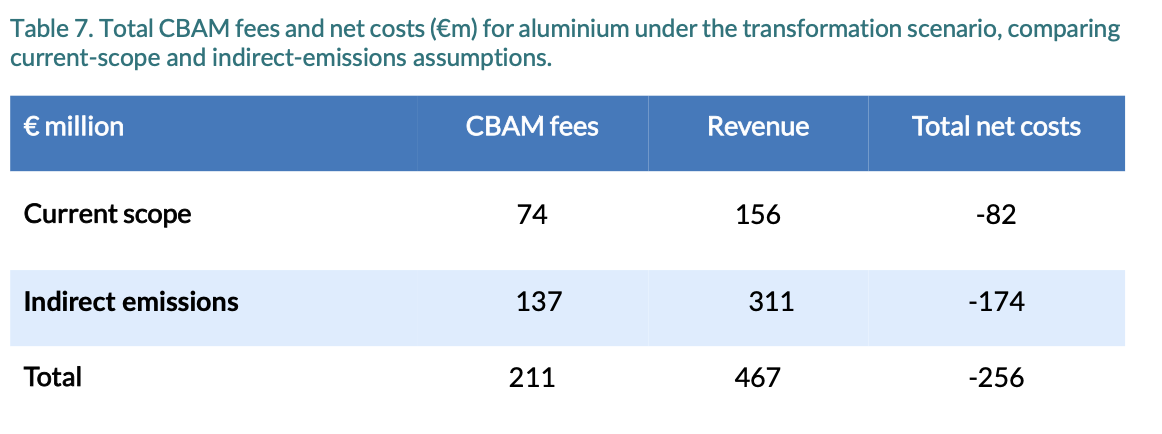

If the additional aluminium production were exported to the EU, CBAM fees applied to Ghanaian exports would amount to €74 million under the current CBAM scope, while EU price pass-through would raise export revenues to around €156 million, resulting in an overall net gain of €82 million. If indirect emissions were included in the CBAM, CBAM fees would rise to €211 million (instead of €74 million), but higher EU price pass-through would more than offset this increase, leading to a net gain of €256 million per year.

Summary of Ghana’s CBAM impact

Ghana aluminium exports consistently record net financial gains, as EU price pass-through exceeds the value of CBAM certificates. This remains true even after implementing a development plan that is not particularly aimed at reducing climate impacts.

Conclusion

CBAM is not necessarily a cost for Africa. In Ghana and Namibia, Sandbag’s modelling shows how the mechanism could create net gains for exports to the EU. In Namibia this would result from green development plans, but for Ghana, industrial exports could benefit from the CBAM even without additional climate measures.

Note: Full references, data sources, and methodological details are provided in the corresponding PDF.

Related Publications

More on the CBAM

The EU CBAM gives a boost to Algeria’s iron exports

Sandbag’s brief assesses how the EU Carbon Border Adjustment Mechanism (CBAM) may affect Algeria’s iron and steel exports. It finds that although Algeria’s overall exposure to CBAM is limited, rising EU carbon costs are likely to increase EU market prices, with implications for the revenues and competitiveness of Algerian exports.

CBAM and Fertiliser Inflation in 2026: The facts behind the numbers

Estimates suggesting that the EU’s Carbon Border Adjustment Mechanism (CBAM) could increase fertiliser prices by up to 30% have brought a central question into focus: how

significant is the inflationary impact likely to be?

Chemicals in the CBAM: Time to step up

Sandbag’s latest brief explains why the EU CBAM must be expanded to cover key chemical value chains. With chemicals and refinery products responsible for 30% of industry emissions, phased inclusion is critical to prevent carbon leakage and phase out free allowances.