In its press release following the Environment Council’s (ENV) agreement on a general approach for reform of the EU Emissions Trading System (ETS), the European Steel Association (EUROFER) accuses the Council of falling short on carbon leakage protection.

However, as we now move into the Trialogue negotiation stage of the reform process, it is important to make clear to all stakeholders that free allocation to the iron and steel sector will increase significantly from Phase 3 to Phase 4 under the Council’s position. It will increase still further under the European Parliament’s position – and that is even before the impact of the last-minute amendment to increase the sector’s benchmark to account for the full carbon content of waste gases[1]. Even the original Commission reform proposal will result in a significant step change upwards in free allocation from Phase 3 to Phase 4.

Given that the whole purpose of the ETS is to apply steadily increasing price signals for abatement investment under the polluter pays principle, this step change increase in free allocations must surely be an unintended consequence of the reform.

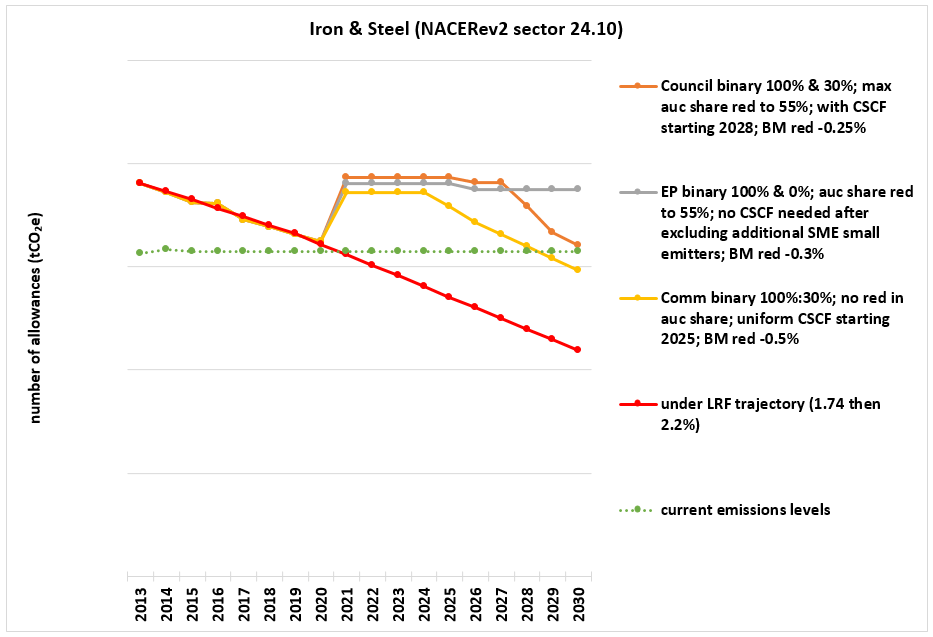

Chart 1 below shows the step change increase in free allocation to iron and steel under each of the three reform positions – Council[2], Parliament[3] and Commission[4]. It also illustrates the sector’s current level of emissions and compares the trends to the LRF trajectory[5].

So far, Phase 4 reform is certainly not heading towards a tightening in allowance supply to this sector. Nor is it lowering the level of carbon leakage protection.

Chart 1. Trend in free allocation to iron & steel (NACERev2 sector 24.10); 2013-2020 from EUTL; post-2020 from Sandbag modelling of Council, Parliament & Commission reform positions (LRF2.2% continued from 2020cap & 0% activity growth in all 3 cases)

It would be easier for stakeholders concerned about the current slow pace of industrial emissions abatement to accept this step change increase in free allocation if it were to be accompanied by a meaningful near-term attenuation of the ongoing total cap to actual and expected emissions levels. Continuing strong power sector emissions reductions are likely to keep pace with, or even exceed, reductions in market supply – even under the Council’s proposed enhanced MSR measures[6]. Prices are expected to remain well below the level currently used to estimate carbon leakage exposure[7] [8].

It is fair to point out that the uniform cross-sectional correction factor (CSCF) applied for all sectors across the whole of Phase 3 does mean that even best performers in sectors meeting the criteria for carbon leakage protection are not being allocated 100% of their benchmarks. However, as can be seen in the chart above, the resulting squeeze on free allocation for Phase 3 has been no faster than the decarbonisation trajectory of the overall cap (the LRF%). It is also fair to point out that, as the iron and steel sector transfers some of its free allocation to third party power generators along with some of its waste gases, it is likely to have negative annual supply balances during Phase 3. However, the European institutions have been generous with industrial sectors. The iron and steel sector built up a significant cumulative surplus of allowances during Phase 2. At current emissions levels, we estimate that this sector will start Phase 4 still with a small positive balance[9].

EUROFER is effectively pushing to further increase free allocations from the levels already established for Phase 3. These allocation levels were challenged in the Court of Justice and upheld[10].

EUROFER’s press release also aims to steer the negotiations away from the strengthened Market Stability Reserve (MSR) measures adopted in the Council position whilst at the same time promoting the Parliament amendments to exempt this sector from any CSCF and to increase its benchmark.

Yet, with no CSCF, participants who proceed along a decarbonisation path in line with their annual benchmark reductions will face no increase in the number of allowances they need to buy for compliance. Furthermore, a 0.3% annual benchmark reduction translates to just 6%[11] improvement from 2008 right through to the end of Phase 4. The ETS is intended to reduce traded sector emissions by 43% in 2030 compared to 2005 levels[12].

We hope this helps to put EUROFER’s complaint into perspective. As more regions of the world introduce carbon pricing, risk of carbon leakage is decreasing not increasing. The proposals on the table increase the level of carbon leakage protection enjoyed by this sector. Together with all other industrial sectors, this sector must play its part and speed up its emissions reductions if the world is to avoid still more dangerous climate change.

It’s time to introduce alternative measures to reduce carbon leakage risk – border adjustment measures, anyone?

———————

[1] This amendment was voted in by Parliament despite the use of such waste gases to generate electricity. (power sector installations no longer receive any free allocation, with the exception of the Article 10c derogations for some Member States)

[2] For Council NER from Ph3; 400 million Innov Support from FA; binary CL at 100% & 30%; min BM red -0.25% for Iron and steel & Refined petroleum, -1.5% for Paper and paperboard & Fertilisers, -1% rest; auction share red by max 2% points to 55% to delay CSCF

[3] For Parliament NER from Ph4; 300 million Innov Support from FA; binary CL at 100% & 0% but with 30% FA for district heating; min BM red -0.3% for Iron and steel & Refined petroleum, -1.5% for Paper and paperboard & Fertilisers, -1% rest; auction share red to 55% to avoid a CSCF; additional SME small emitters excluded from post 2020 FA

[4] For Commission NER from Ph3; 400 million Innov Support from FA; binary CL at 100% & 30%; min BM red

-0.5% for Iron and steel & refined petroleum, -1.5% for Paper and paperboard & Fertilisers, -1% rest; auction maintained at 57%; CSCF triggered in 2025

[5] Sandbag calculation assuming a year over year reduction of -1.74% of 2010 FA for Ph3 and a year over year reduction of -2.2% of 2010 FA for Ph4

[6] Further Sandbag analysis to follow in a briefing due out later this month; see our press release on the Council position here

[7] EUA price is currently hovering around €5/tonne, i.e. considerably lower than the €30/tonne price applied when assessing current carbon leakage exposure

[8] See Carbon Pulse 10 Mar, ~€15/tonne expected for the earlier 2020s

[9] Sandbag estimates NACERev2 sector 24.10 will have a small positive balance of around 55 million by 2020 (free allocations + offsets – waste gas transfers – emissions); WGT estimated following a methodology shared by a sector source

[10] See here

[11] 20 x 0.3 (20 years from 2008 to middle of 2nd half of Ph4)

[12] EU 2030 climate & energy framework see here