Carbon Border Adjustments in the EU: who, what, when, why and how?

Who? What sectors should the CBAM apply to? What countries? What will the consequences be for EU producers availing of free allocation?

The CBAM should prioritise emissions-intensive sectors covered by the EU ETS, like cement, steel, electricity, plastics and ammonia. It should be applied to all the EU’s trade partners, with special provisions for those who have their own form of carbon pricing. Free allowances will need to be abolished as the CBAM is introduced.

What? Should the CBAM apply to direct or indirect emissions? To all products or only emissions-intensive commodity materials?

For the sake of administrative simplicity and for maximising the climate impact of the CBAM, it should focus on direct emissions from very emissions-intensive commodity materials. Covering all imports would be very challenging and carbon leakage is not a major risk for more complex products.

When? A rapid introduction or a gradual phase-in period? How will this interact with the phases and planned reforms of the EU ETS?

The CBAM should be introduced as soon as possible, along with timely reform of the EU ETS that sees an end to free allocation and aligns the ETS cap to the net-zero 2050 goal.

Why? What is the real aim of the CBAM? To prevent carbon leakage, to encourage global climate ambition or to raise EU revenues?

To prevent carbon leakage by correcting the competitive distortion that will be created by an increased ambition (higher reduction target + abolition of free allocation). Influencing the policies of other states and raising revenues may be beneficial side effects but should not be the main goal.

How? What will the mechanism look like? How will it interact with the EU ETS? How to estimate the carbon content of imported products?

Price-wise, the CBAM should be based on the EU ETS price, either by bringing imports under the EU ETS or by having a border tariff that closely mirrors the EU ETS price. Volume-wise, we propose to base the CBAM on the average EU carbon intensity per product, granting discounts to imported goods based on carbon costs actually paid in their countries of origin. Similarly, EU exporters would get rebates equal to the carbon costs actually paid by the relevant domestic production facilities.

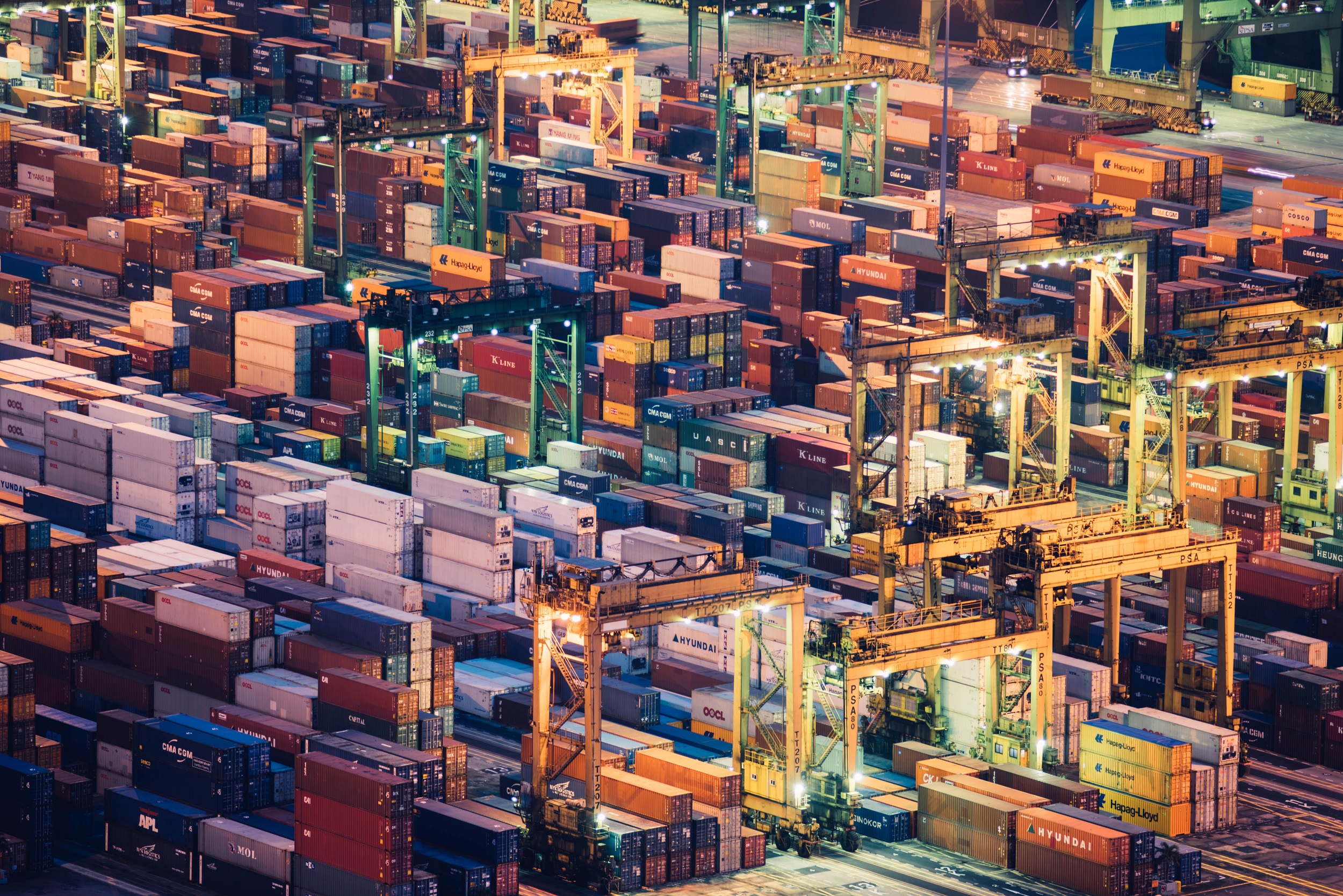

Image credits: CHUTTERSNAP on Unsplash