This brief analyses 2023 emissions under the EU Emissions Trading System (EU ETS), using the latest data available from the EU Transaction Log (EUTL). It particularly focuses on the iron and steel sector.

2023 ETS data overview: a stable surplus of allowances

In 2023, emissions from stationary installations equalled 1,096 million tonnes of CO2 equivalent (m tCO2e), a 16.5% decrease from the 1,313m tCO2e recorded the previous year. This decline is even steeper than the 15.5% reduction reported by the European Commission based on preliminary data.

Stationary emissions were 390m tCO2e, which is 26% lower than the ETS cap that was set to 1,486m tCO2e. The Market Stability Reserve (MSR) withdrew 322 million European Union Allowances (EUAs) from the market. Of the remaining 1,164 million allowances, only 1,055 million were distributed, while the remaining 109 million was kept aside in different reserves.

The total surplus of allowances only marginally decreased to 1,068 million at the end of 2023, compared to 1,109 million in 2022. Besides, in 2023, 528 million allowances were allocated for free to industry (excluding the power sector), covering 84% of total industry emissions. This represents an increase compared to 2022, where 78% of emissions were covered by free allowances.

Steel emissions dominate industry emissions

A revised sector allocation better reflects the impact of iron and steel

Our analysis reveals that while the power sector remained the main source of emissions in the EU ETS, with 471m tCO2 (i.e. 41% of total emissions), down 25% from 631m tCO2 in 2022 – iron and steel was the leading emitter within the industry.

We integrated certain power plants (labelled “combustion” under EUTL activity types) into the iron and steel sector, as we believed it more appropriate to attribute emissions from the combustion of blast furnace or coke oven gases in power plants to iron and steel. Our reasoning was that these emissions are driven by the activity of steel mills rather than by electricity demand.

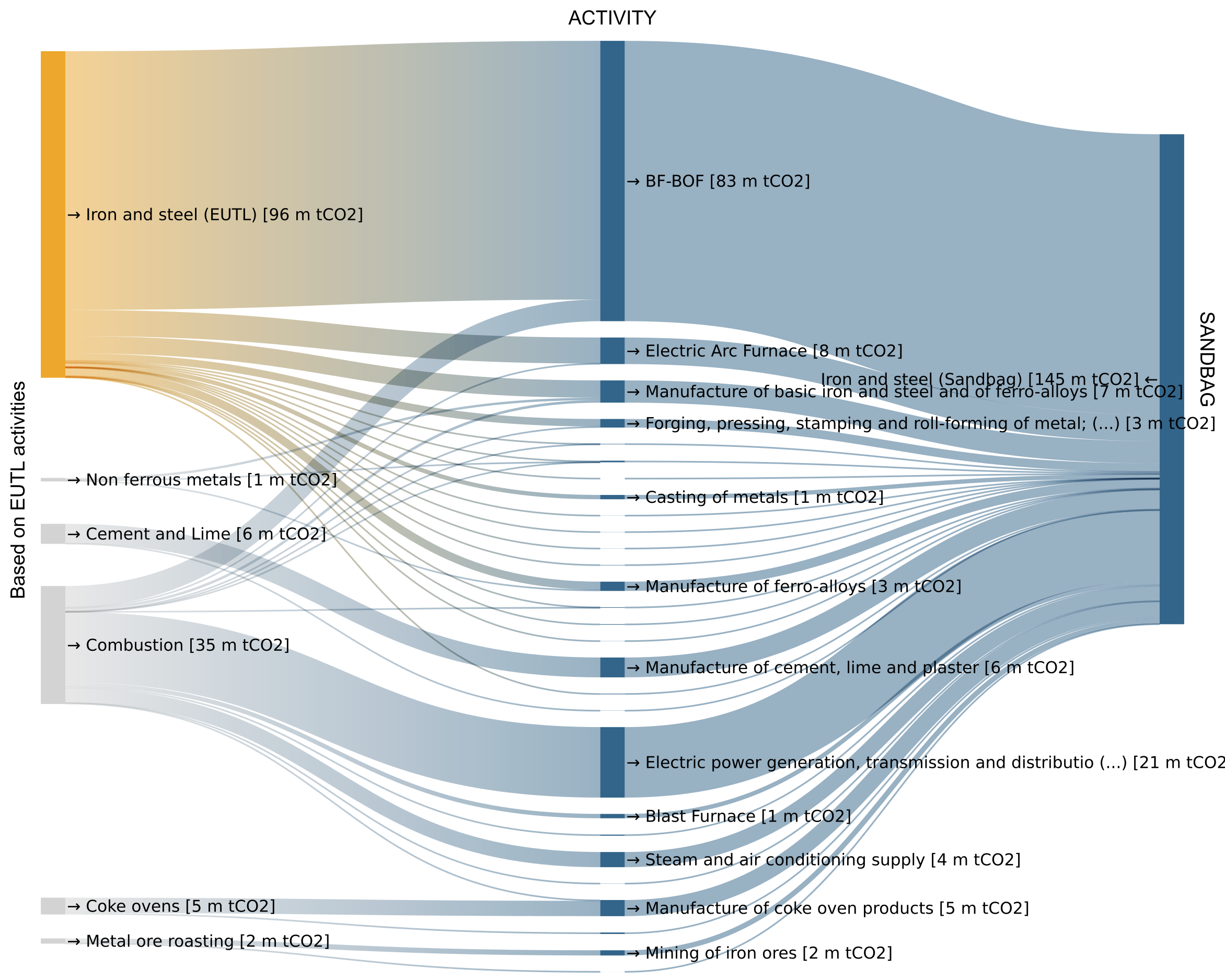

We also grouped under “iron and steel” emissions from coke ovens, ferro-alloy manufacturing and the production of lime used for steelmaking (based on geo-localisation data). Our categorisation distinguishes emissions between power and heat production (which are bundled together in the EUTL) and, where applicable, attributes heat production emissions to their respective value chain (chemicals, mineral oil etc.). The Sankey diagram below illustrates how this mapping worked out for iron and steel.

Photo by freestockcenter

Steel value chain installations

In the Sankey diagram, the correspondence between EUTL-based (left) and Sandbag (right) classification uses “activity” information based on those other collected data types.

Iron and steel: the largest industrial emitter

Under this sector allocation, iron and steel come out as the most emitting industrial sector, with 145m tCO2 in 2023, far ahead of cement and lime (124m tCO2). By comparison, with a sector breakdown based on EUTL activity types, iron and steel plants only emitted 96m tCO2, ranking third behind cement and lime (117m tC02) and mineral oil (105m tCO2).

As a result, the iron and steel value chain accounted for 25.5% of the total 569m tCO2s emitted by all industry plants covered by the EU ETS in 2023.

All these data are available in our interactive dashboard.

Read more publications

Sandbag’s feedback to the call for evidence on the Circular Economy Act

Sandbag welcomes the Circular Economy Act (CEA) as an important step to accelerate the transition to a circular economy in the EU. Progress in this area has been slow and this act is sorely needed to address systemic issues holding back circularity, including the current fragmented approaches across Member States.

State Aid for Indirect Carbon Costs: Reform before extending!

Sandbag responds to the EU’s consultation on State aid for Indirect Carbon Costs (ICC), calling for targeted reforms to better support clean electricity, avoid windfall profits, and align with the Carbon Border Adjustment Mechanism (CBAM).

New Principles for Steel Labelling: response to the consultation on the Industrial Decarbonisation Accelerator Act

Sandbag’s response to the EU’s Industrial Decarbonisation Accelerator Act sets out four principles to guide green steel labelling schemes, promoting credible standards based on lifecycle emissions and system-wide decarbonisation.