-

Agreement on higher Market Stability Reserve absorption rate and automatic cancellation of some of the surplus is a welcome step forward, but is unlikely to be enough to cope with the continuing gap between allowance supply and emissions.

-

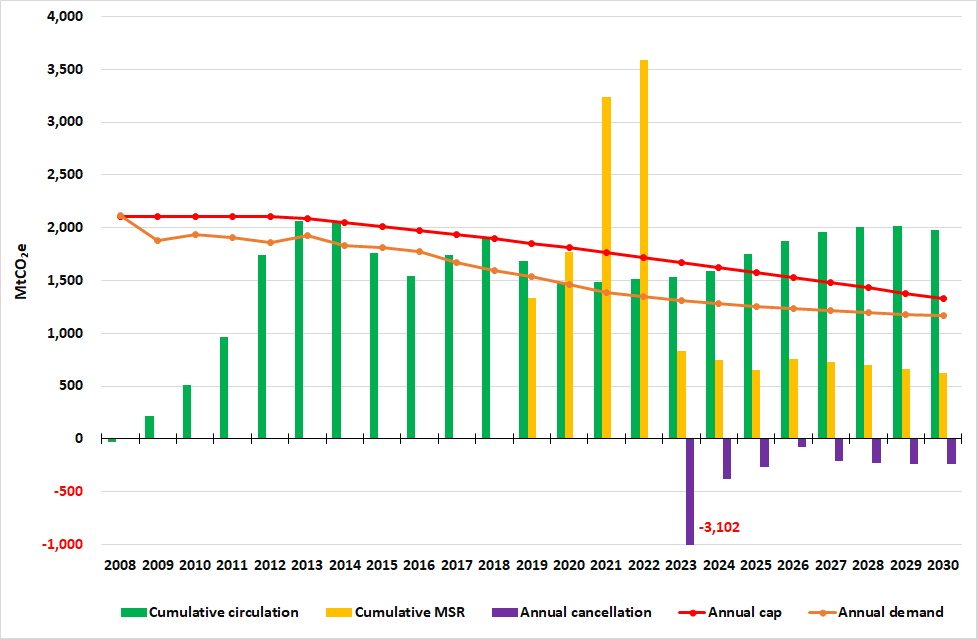

If EU emissions continue to fall at their historic average rate, the reform still leaves the EU carbon market with a surplus of around 2 billion tonnes of CO2 available to the market in 2030 (see graph). This would prevent the EU ETS carbon price rising significantly.

-

The ETS is left without an automatic ratchet mechanism to ensure that it can be tightened progressively in line with the Paris Agreement.

Last night’s trialogue agreement failed to restore the ETS as Europe’s flagship climate policy. Emission reductions for the foreseeable future will now be dependent on other EU and Member State policies.These include direct efforts to phase out coal, increase renewables growth and support industrial innovation.

If EU emissions continue to fall at the historic average rate, the reform still leaves a surplus of 2 billion tonnes of CO2 available to the carbon market in 2030, higher than the surplus today. This surplus is unlikely to deliver a carbon price high enough to even able to drive the lowest-hanging fruit of emission reductions: electricity generation switching away from coal.

We welcome the indication that Article 10c. and the other ETS funds appear to exclude high-carbon intensity fuels such as coal. Member States and the Commission must now take responsibility for ensuring that indeed no ETS funds can be used to fund coal generation. The agreement that Article 10c funds “do not contribute to or improve the financial viability of highly emission-intensive electricity generation nor increase dependency on emission-intensive fossil fuels” is too ambiguous. European power must be coal-free by 2030: there is no room for confusion.

In failing to target free allocation to industry sectors most at risk of carbon leakage, the reform misses the opportunity to dedicate more auction revenues to support low carbon innovation. Incumbent industry will receive little price stimulation to move beyond current best available technologies and materials.

Sandbag’s model of the ETS reform agreement shows that with emissions continuing to fall at around the average rate, the carbon market will have a surplus available to the market of 2 billion in 2030. See full modeling assumptions below.

Rachel Solomon Williams, Managing Director commented:

“Last night’s agreement maintains the EU carbon market as a climate change policy in name only. Progress in some areas, although welcome, has failed to deliver a coherent system, and billions of surplus allowances will continue to prevent the meaningful carbon price the EU sorely needs.

The logic of the Paris Agreement is that all countries need to step up ambition to cut emissions. With the ETS hobbled, the EU and Member States must now immediately look to how emissions can be cut rapidly before 2020 and in the period up to 2030. Accelerating coal plant closures, and supporting the efforts of industry to decarbonise, is essential.”

Notes on our emissions forecast

Emissions under the ETS have fallen on average 2.9% from 2005-2010, and 2.6% from 2010-2016 (taking into account scope corrections). The Sandbag model shown assumes an ongoing average 2.8%/year fall, which would entail accelerating coal phase-out and some industrial emissions reductions. However, if emissions do not fall as fast as we are expecting, the surplus could be as low as 500 million by 2030, which could lead to a higher carbon price.

Sandbag’s model assumes:

- emissions reductions at 2.8% a year;

- no cap flexibility i.e. 2.2% LRF continuing from 2020

- no ongoing net demand from aviation

- max increased Article 10c derogation

- doubling MSR withdrawals until (&incl) 2023

- 25 million from MSR to Greece

- MSR cancellations from 2023

- max 3% auction share reduction to avoid CSCF

- 2% Modernisation Fund

- 350 million NER from MSR

- 450 Innovation Fund (400 from FA share & 50 from MSR)

Cover image with thanks to Thomas Hafeneth, used under a creative commons licence