How weak EUETS reform will not keep pace with falling coal and growing renewables

Sandbag has spoken at events recently in Berlin, Brussels and London, discussing the outlook for the ETS under the proposed reform. Below, we summarise those presentations.

Sandbag’s annual emissions forecast for the EU carbon market has repeatedly been the most accurate in the business. Now we forecast that, given current reform proposals, the Emissions Trading System faces another lost decade of high surplus and resulting low carbon price. Yet other analysts remain bullish as ever, continuing to predict a rising carbon price. What do we see in the market fundamentals that others have missed, and how can ETS reform be improved to account for the uncertainty of emissions in the next decade?

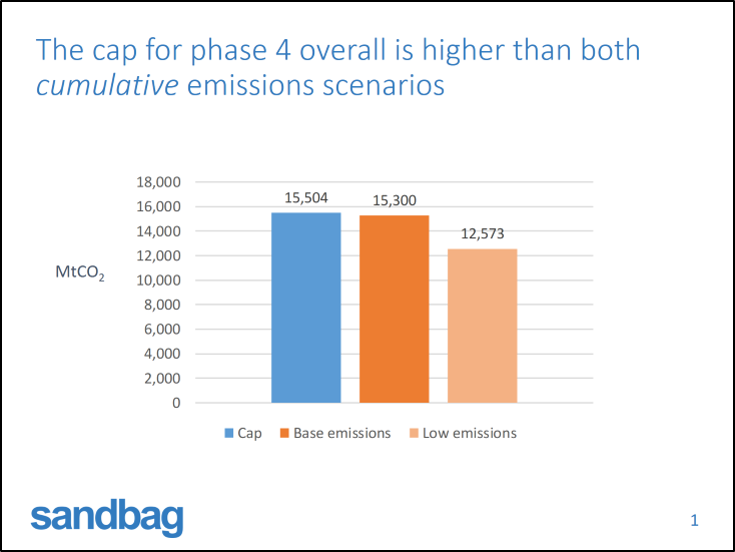

- The overall cap for Phase 4 is higher than the base emissions forecast

- Overlapping policies will bring emissions down faster, and so reduce demand for EUAs. Some of these non-ETS policies and changes are:

- Accelerating coal phase-out as LCP BREF bites + regional carbon taxes + capacity payments EPS

- Energy efficiency target of 40% by 2030

- Accelerating subsidy-free renewables build

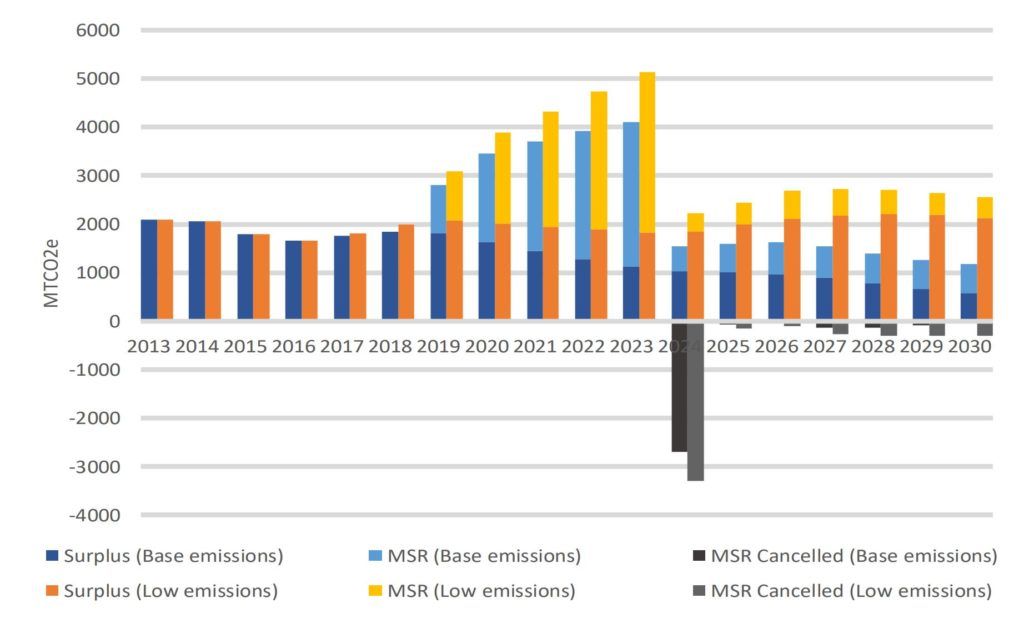

- The proposed MSR outtake rate cannot keep pace with the growing surplus

The ETS cap for Phase 4 is higher than forecast cumulative emissions

At the most basic level, the number of allowances released under the cap during Phase 4 will be higher than both our base case emissions scenario, which is similar to other analysts’, and is much higher than our low emissions forecast. This clearly leaves a surplus. It also loads the MSR with the job of removing from the market both the legacy surplus from Phase 3 and the newly created surplus throughout Phase 4. Will the MSR work fast enough to stop the continuing surplus from dampening the carbon price?

A number of climate policies overlap with the ETS, and are set to continue to reduce demand for EUAs

A number of recently decided or shortly to be confirmed European and national policies are designed to help reduce emissions. For example:

- Energy efficiency will reduce electricity demand, which will reduce the need for coal generation.

- The elimination of biomass co-firing will reduce subsidies to old coal power plants.

- There will be ETS and other funds available for the transition away from coal power and mining in carbon-intensive regions, which means it will be less difficult for these regions to move beyond coal.

- Regional carbon floor prices will render coal power plants much less profitable.

The EU’s 280 coal plants are responsible for 39% of ETS emissions. An accelerating coal phase-out will boost the ETS surplus and keep the carbon price low.

These 280 coal power plants generated 39% of all EU ETS emissions in 2016 (hard coal in black, lignite in yellow). Not only are they responsible for a larger proportion of emissions than any other sector in the ETS, but their emissions are seeing much bigger changes, with 2016 coal emissions alone falling by 11%. The IEA sees no coal in Europe by 2030 under its ‘Below 2 degrees’ scenario, and we expect policymakers to increasingly work towards that goal.

To understand the ETS, we need to understand the outlook for Europe’s coal power plants.

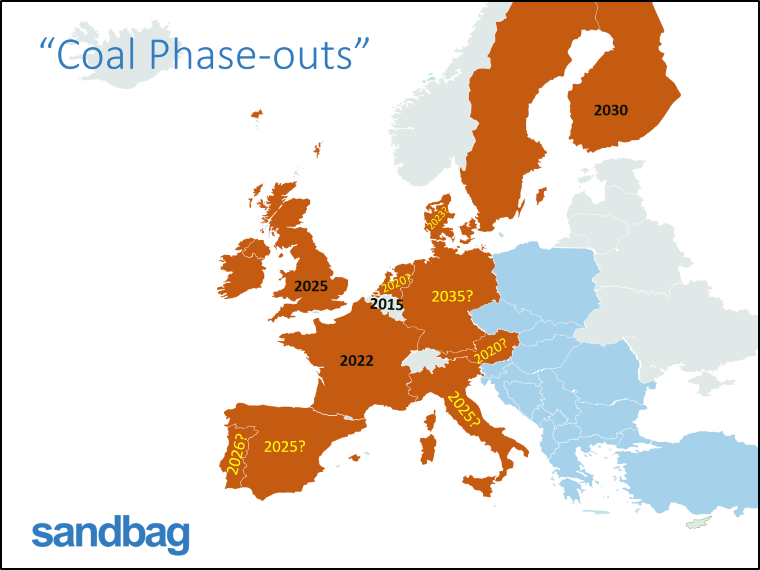

Across Europe, Member States have committed to coal phase-outs, reducing emissions and so the demand for EUAs

There is a whole host of advantages of knowing when coal plants will close. It makes security of supply easier to achieve, it makes planning for new investment cheaper, it makes hitting national climate targets and also air pollution targets more certain – with associated health benefits – and it makes it easier to help affected workers.

It’s no wonder that countries are keen to plan coal phase-outs. This is coming as soon as 2022 for France and 2025 for the UK, and with hope that the new German governing coalition containing the Greens will soon set a date for their own phase-out.

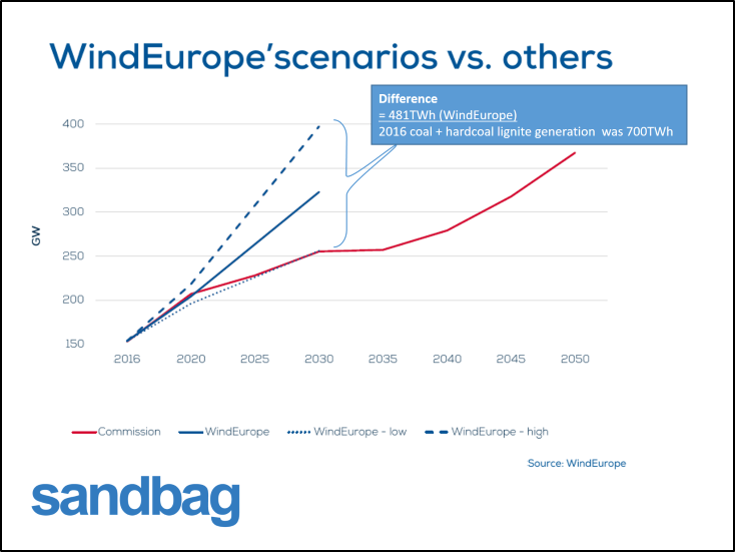

WindEurope’s recently released forecast show just how fast renewables are growing in Europe, now offshore wind, onshore wind and solar + batteries are close to subsidy-free

Meanwhile, renewable energy growth is surging (this image is from WindEurope’s new scenarios, launched on 26 September). Offshore wind is now near subsidy-free, and undercutting new build gas in many places. The cloudy UK just launched its first subsidy-free solar farm, crucially working in tandem with new low-cost batteries. Power generation is increasingly switching from coal direct to renewables, rather than gas, with a larger influence on emissions.

Even with the Council proposal, the ETS remains oversupplied by 1-2Bt in 2025, suggesting little change in the carbon price from today

Therefore, Sandbag’s outlook for the surplus on the market during Phase 4 following ETS reform is not dissimilar to today, with 1-2 billion surplus through most of the 2020s, and by deduction, a carbon price still struggling to reach a meaningful level.

The outlook for emissions and the carbon price is fundamentally uncertain, and it’s possible emissions do not fall as fast as we have predicted. But the ETS must be made resilient to falling emissions. Sandbag are proposing a five-yearly reset of EUA supply, to ensure that we’re not just bailing out the overflowing bath, but also turning off the taps.