Publications

Explore our evidence-based research and policy recommendations!Supply-demand analysis of EU ETS reform: Letting Industry Loose

A storm in a teacup: impacts and geopolitical risks of the European Carbon Border Adjustment Mechanism

New study shows limited trade impacts of European Carbon Border Adjustment Mechanism

ETS reform: under the hype, a sense of déjà-vu

A Storm in a Teacup: preliminary findings on the CBAM proposal

Sandbag’s analysis of the European Commission’s leaked proposal for a CBAM highlights its limited trade scope but significant climate policy implications. Although the covered goods represent a small fraction of EU imports (just 0.8% from China) the sectors involved receive nearly half of all free EU ETS allowances. The CBAM aims to replace these with a carbon pricing mechanism on imports, particularly affecting steel and aluminium. While importers may face increased costs, much of this is expected to be offset through higher consumer prices.

Untangling the knots – Clearing the way to fast green hydrogen deployment

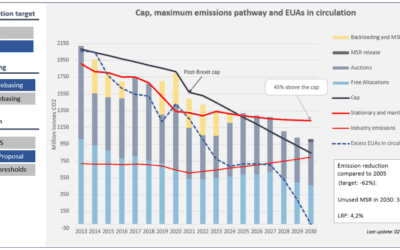

EU ETS emissions plummet due to pandemic as EUA surplus skyrockets

Harnessing EU Funds for Romania’s Energy Transition

European Parliament clings to false solutions in Hydrogen Strategy vote

European Parliament approves CBAM report but fails to take firm stance on Free Allocation

WHAT WE DO

TOOLS

PUBLICATIONS

NEWSLETTER

Mundo-b Matogné. Rue d’Edimbourg 26, Ixelles 1050 Belgium.

Sandbag is a not-for-profit (ASBL) organisation registered in Belgium under the number 0707.935.890.

EU transparency register no. 277895137794-73.

VAT: BE0707935890.