EU Emissions Trading System (ETS)

We conduct research on the EU Emissions Trading System (ETS) to make it efficient and effective at reducing emissions.

What is the EU ETS?

The EU ETS is the European Union’s flagship climate policy, designed to reduce greenhouse gas (GHG) emissions cost-effectively.

By creating a market of emission permits, it incentivises individual installations in sectors like power generation and heavy industry to cut emissions.

It was extended to the shipping sector in 2024 and is connected to an ETS covering aviation.

How does it work?

- Cap-and-trade system: A legal cap limits total emissions in sectors like power generation and heavy industry. This cap decreases annually to drive decarbonisation.

- Allowances and trading: Allowances are tradable, creating a carbon market. Companies must surrender one allowance per tonne of greenhouse gas (CO2, N20, PFC) emitted.

- Carbon price: Limiting allowance supply drives a market-based price, allowing factories to decarbonise cost-effectively.

Ongoing challenges

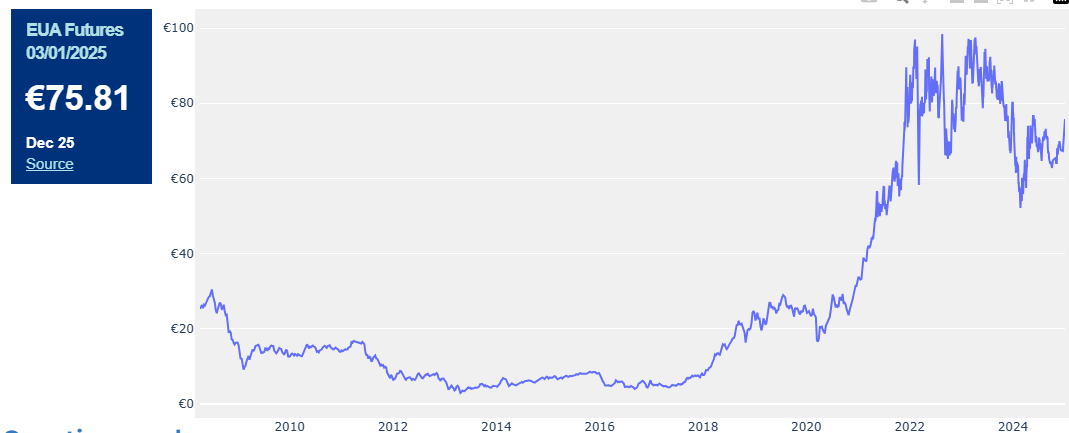

- Until 2018, an oversupply of allowances kept carbon prices very low, providing no incentive to cut emissions.

- Today, prices are higher but free emission allowances and state aid compensation for indirect carbon costs, continue to create unfair competition between polluting and less-polluting processes and products.

Our work

Our tools

We develop in-house tools to help policymakers and stakeholders understand and improve the EU ETS.

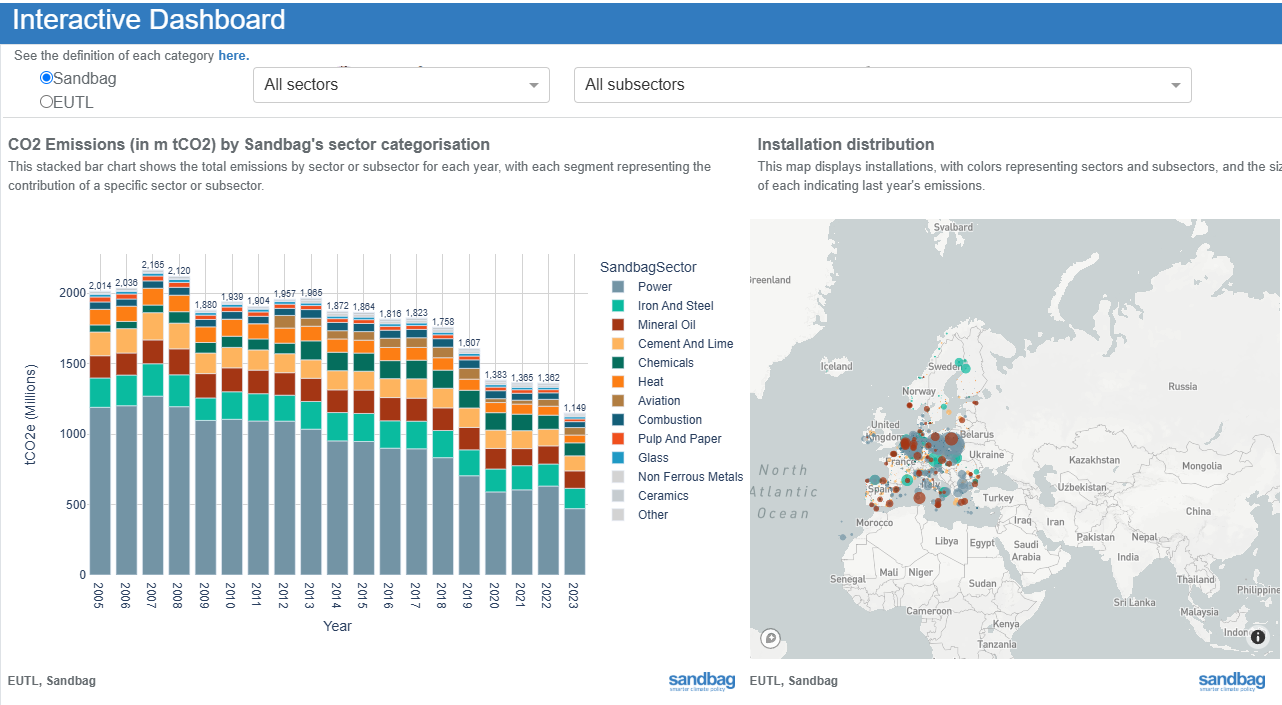

EU ETS Dashboard

Explore sector-specific emissions data within the EU Emissions Trading System at various levels of granularity.

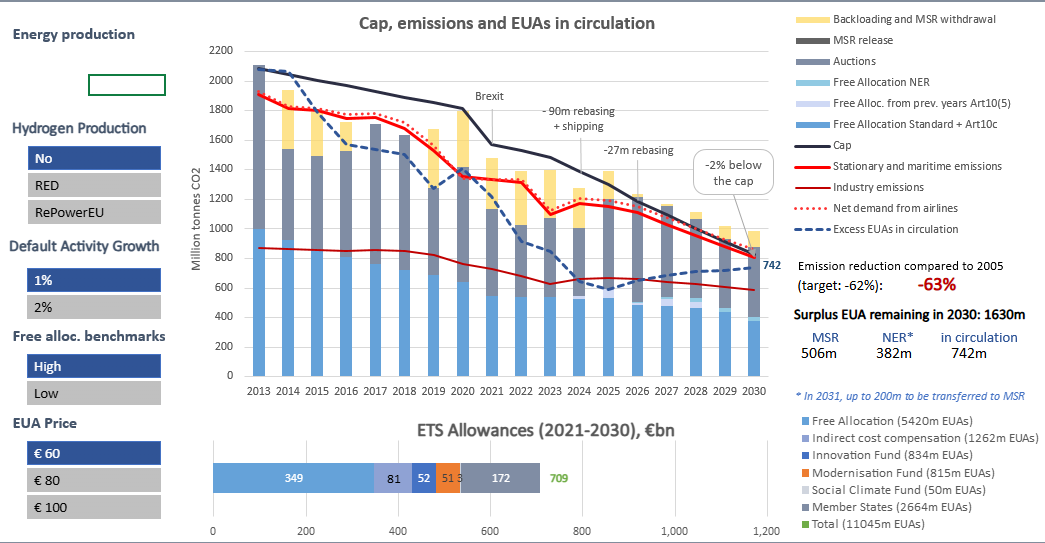

EU ETS Simulator

Analyse the impact of policy adjustments on the EU ETS.

Carbon price viewer

Check and analyse the evolution of EU carbon price over time.

Latest publications on the EU ETS

We deliver data-driven and evidence-based policy recommendations though, direct feedback to institutions, reports and policy briefs.

Our achievements

February 2024: ETS benchmarks updated to reflect low-carbon production routes

In February 2024, ETS benchmarks were amended to better reflect emerging decarbonisation pathways, including the recognition of alternative binders in cement and direct reduced iron (DRI) in steel. These updates aligned with Sandbag’s long-standing analysis and technical input highlighting the need for ETS benchmarks to reflect low-carbon production routes, in order to improve investment signals for industrial decarbonisation.

Our messages

Keeping up with ambitions

The ETS cap is set to reach near zero by 2039 – an achievable goal, partly due to the large surplus of allowances already in the system. There is no need to weaken this ambition by lifting the cap or letting offsets in.

Phasing out free allocation quickly

Free allocation should be phased-out quickly, and accompanied by an efficient implementation of the Carbon Border Adjustment Mechanism (CBAM) to prevent carbon leakage. More about the CBAM.

Reforming free allocation

While it IS still on, free allocation should better level the playing field for – at least – some cleaner alternatives such as steel recycling.

Reforming compensation for indirect carbon costs

This State aid should support businesses for using intermittent renewable electricity rather than stable grid electricity.

Reforming the Innovation Fund

Public money from the Innovation Fund should be better spent. Grants should prioritise early-stage innovation, while mature technologies should only receive performance-based subsidies.

Read our latest publications

The EU ETS at a Crossroads

Sandbag’s latest submission to the EU ETS and Innovation Fund consultation calls for clearer rules on free allocation, stronger criteria for funding innovation, and safeguards against misleading carbon accounting practices.

In or Out: What’s best for carbon removals and the EU ETS?

What will the future of the EU Emissions Trading System (ETS) look like as the emissions cap heads towards zero? Is integrating carbon dioxide removals (CDRs) into the ETS a solution to help the EU achieve its climate goals? Or would they compromise the integrity and functioning of the system? These questions are at the forefront of the Commission’s mind as they review different options for the future of the ETS ahead of the 2026 revision.

A closer look at 2023 emissions: steelmaking caused a quarter of industry pollution

This brief analyses 2023 emissions under the EU Emissions Trading System (EU ETS), using the latest data available from the EU Transaction Log (EUTL) . It particularly focuses on the iron and steel sector.

Get involved and support us towards this effort!

While these developments mark important progress, we need more profound changes for the EU ETS to effectively drive decarbonisation at the scale and pace required.

WHAT WE DO

TOOLS

PUBLICATIONS

NEWSLETTER

Mundo-b Matogné. Rue d’Edimbourg 26, Ixelles 1050 Belgium.

Sandbag is a not-for-profit (ASBL) organisation registered in Belgium under the number 0707.935.890.

EU transparency register no. 277895137794-73.

VAT: BE0707935890.