This report considers the Market Stability Reserve (MSR) cancellation options for Phase 4 of the EU Emissions Trading System (EU ETS).

A combination of elements from the European Parliament and Council positions, if maintained in trialogues, would leave the EU ETS in better shape – but with further to go to guarantee cost-effective emissions reductions.

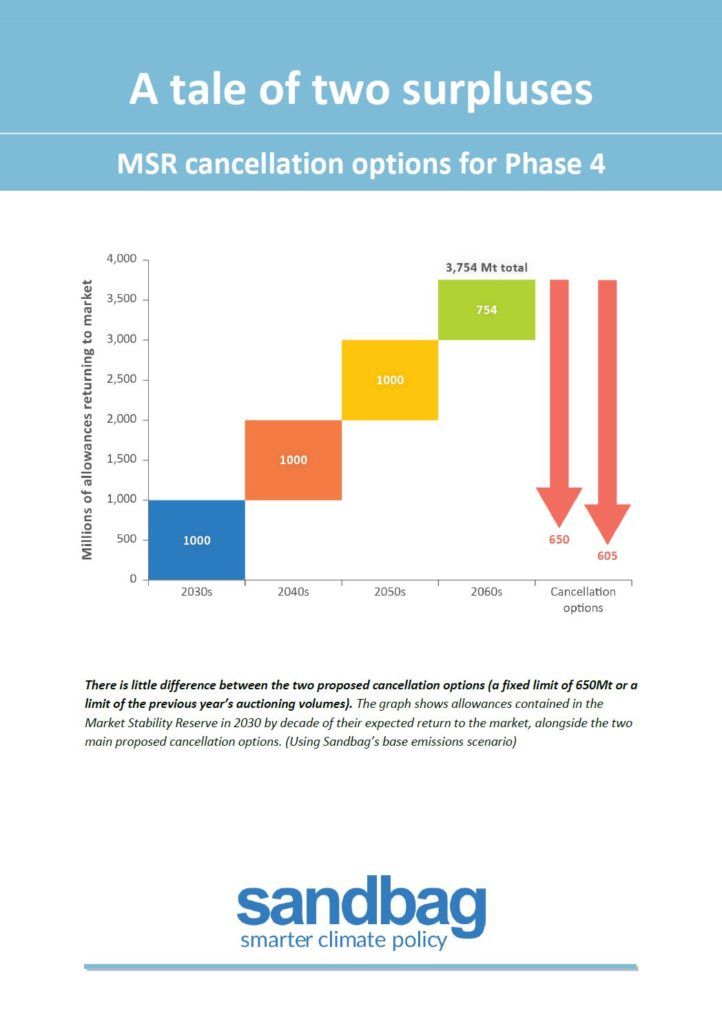

- The persistent surplus in the EU ETS is composed of two main elements – the surplus available to the market and the surplus which has not yet been released. The bulk of the latter will be transferred to the MSR from 2019.

- The two elements of the surplus affect the price signal generated by the system in different ways, therefore any changes to the rules will lead to different price impacts.

- The Council position on annual cancellation from the MSR is a particularly positive proposal, especially combined with doubling the MSR withdrawal rate. These changes would initially increase the speed with which the MSR takes allowances from the market during Phase 4 (up to 2030), supporting an increased carbon price. Under our base emissions, the reform theoretically removes the surplus on the market by the early 2030s, but in reality, this outcome isn’t certain; it will depend on the actual level of emissions.

- However, these changes are only part of the solution. With a current surplus in circulation of 1.7 billion tonnes in the EU ETS, we still forecast a surplus available to the market of over 1 billion tonnes in 2025. In a “low emissions” scenario (e.g. if coal plants close more quickly than expected) the reforms will not remove the surplus on the market by the end of Phase 4, carrying a surplus of over 2 billion tonnes into the 2030s.

- No amendments currently on the table address the impact on the market surplus of overlapping policies for power sector emission reductions, despite the potentially large cancellation of allowances stored in the MSR. We therefore believe that the withdrawal rate of the MSR should be increased beyond 24% for the whole period 2021-2030.

- Most importantly, the changes would represent only a temporary fix to a structural problem, which requires a structural response. The disconnect between the cap and real emissions is the main reason why the EU ETS is not delivering its intended price signal and failing to drive emissions reductions.

We continue to believe that the best solution is to remove the surplus from the market quickly by readjusting the starting point of the Phase IV cap to reflect the real-world level of emissions. The European institutions have correctly decided to link the Effort Sharing Regulation to real emissions; the same should be done for the ETS. It’s a simple question of taking stock: we can’t expect the EU to land in 2040 using emissions estimates from 2007, and this exercise will have to be done periodically.