Carbon Border Adjustment Mechanism (CBAM)

We advocate for a strong CBAM to phase out the allocation of free emission allowances, address carbon leakage, and accelerate global climate action.

About the CBAM

A carbon policy to prevent carbon leakage

- Carbon leakage is the re-location of emission intensive production from Europe to regions with no carbon pricing or less stringent climate regulations.

- To address carbon leakage, the EU allocates free emission “permits” – also known as “allowances” – to emission-intensive EU industries.

- This free allocation system strongly reduces decarbonisation incentives in the EU.

- The CBAM was created to replace free allocation, thereby unleashing the potential to decarbonise EU industries.

- The CBAM puts a price on greenhouse gases emitted during the production of a list of imported goods, to level the playing field between EU and non-EU industries.

- As the free allocation of emission allowances is phased out, CBAM is phased in, ensuring fair competition and avoiding carbon leakage while setting the right incentives for EU industries

Implementation timeline

- Adoption – 17 May 2023

- Transitional phase – 1 October 2023 – 31 December 2025: A pilot period to gather data on embedded emissions and refine methodologies.

- Start of definitive period – January 2026: Importers must submit yearly reports on imported goods and their verified emissions.

- CBAM gradually replaces free allocation – January 2026 to 2034: Free allocation will be gradually replaced by the CBAM.

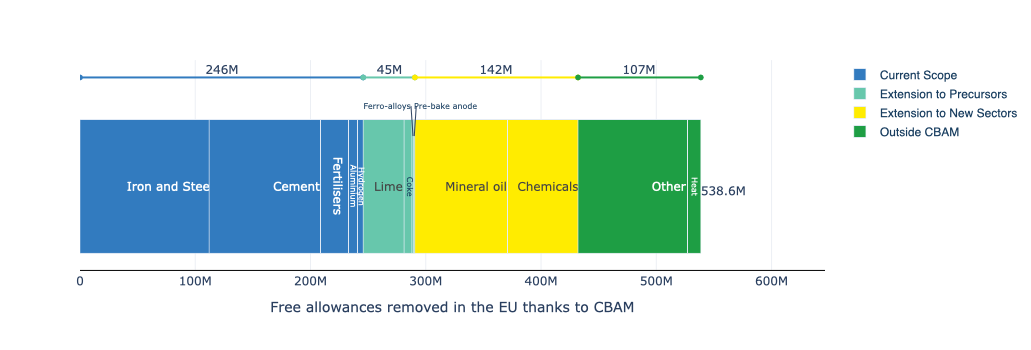

Estimated Phase-Out of Free EU Carbon Allowances (2026–2034) in million tonnes CO₂.

Our work

Researching ways to address the CBAM’s weaknesses

For many years, we’ve been conducting research on:

- Emissions and products covered by the CBAM.

- The impact of the CBAM on trade and competitiveness.

- Reporting requirements and methodologies under the CBAM

Advocating for our solutions

As members of the European Commission’s CBAM Expert Group, we provide evidence-based recommendations to enhance the policy’s effectiveness.

Informing and framing the debate

We share our insights and advocate for improvements, in Europe and beyond, by participating in public events. Recent contributions included:

- 𝗦𝗵𝗮𝗻𝗴𝗵𝗮𝗶 𝗱𝗶𝗮𝗹𝗼𝗴𝘂𝗲 𝗼𝗻 𝗽𝗿𝗲𝘀𝘀𝗶𝗻g energy 𝗮𝗻𝗱 𝗰𝗹𝗶𝗺𝗮𝘁𝗲 𝗶𝘀𝘀𝘂𝗲𝘀, as part of China International Import Expo

- High-level conference on CBAM organised by DG Trésor

- High-level conference on the CID organised by France’s Permanent Representation

Latest publications on CBAM

Our messages

The CBAM is an important climate policy that enables the phase out of free allocation under the EU ETS. Our proposals aim to make the CBAM effective at meeting this objective.

Getting the pricing mechanism right

Including indirect emissions into the CBAM.

Including emissions from inputs such as coke, lime, pre-bake anode.

Avoiding circumvention incentives through e.g. resource shuffling

eg. Attributing emissions to aluminium and steel scrap.

Encouraging the use of default values by our trade partners.

Mitigating circulation of carbon price paid in third country.

Simplifying the system

Increasing the minimum intrinsic value (currently 150 EUR per consignment).

Limiting the inclusion of additional downstream products unless absolutely necessary.

Making the use of default values more systematic.

Read our analysis and policy recommendations

Closing the CBAM scrap loophole – A critical move for climate & competitiveness

This joint op-ed by Norsk Hydro, Alcoa, Bellona Europe and Sandbag was published by Carbon Pulse....

A Scrap Game: Impacts of the EU Carbon Border Adjustment Mechanism

Currently, we are in the CBAM transitional period, with negotiations ongoing for its full implementation in January 2026. Learn about the legislative process and the effect of this policy on the EU’s main trade partners, especially China.

Feedback on the Draft of the CBAM Implementing Regulation

We welcome the Commission's draft of the CBAM implementing regulation concerning the reporting...

Get involved

Support our efforts to develop an effective CBAM that benefits the climate, the EU, and its trade partners.

WHAT WE DO

TOOLS

PUBLICATIONS

NEWSLETTER

Mundo-b Matogné. Rue d’Edimbourg 26, Ixelles 1050 Belgium.

Sandbag is a not-for-profit (ASBL) organisation registered in Belgium under the number 0707.935.890.

EU transparency register no. 277895137794-73.

VAT: BE0707935890.