This report considers the long-term future of the Emissions Trading System, and other options for carbon pricing in the EU.

A major legislative reform process has just been completed. Nevertheless, there clearly remains a gap between the state of ETS (even with the current reforms) and what’s necessary to achieve cost-effective pathways to a prosperous low carbon European economy consistent with the EU’s international climate change obligations.

The report’s five main recommendations are below:

A major legislative reform process has just been completed. Nevertheless, there clearly remains a gap between the state of ETS (even with the current reforms) and what’s necessary to achieve cost-effective pathways to a prosperous low carbon European economy consistent with the EU’s international climate change obligations.

The report’s five main recommendations are below:

Download the Full Report

(Published 7th Dec 2017)

The EU ETS should be retained, but requires further substantial reform to become effective

The ETS has a range of benefits. It sends a strong strategic signal, provides at least some low cost abatement across covered sectors, even at low prices, and may be made more effective in future. It also works as a backstop measure, can be made compatible with complementary policies, and can be aligned with the Paris process. Its abolition would send a very negative signal globally.

However recent reforms have failed to adequately address the fundamental problems with the EU ETS. A process of continuing substantial reform in the coming years is needed to turn the EU ETS into a more effective policy instrument, and so enhance its credibility within the EU and restore the EU’s leadership internationally.

However recent reforms have failed to adequately address the fundamental problems with the EU ETS. A process of continuing substantial reform in the coming years is needed to turn the EU ETS into a more effective policy instrument, and so enhance its credibility within the EU and restore the EU’s leadership internationally.

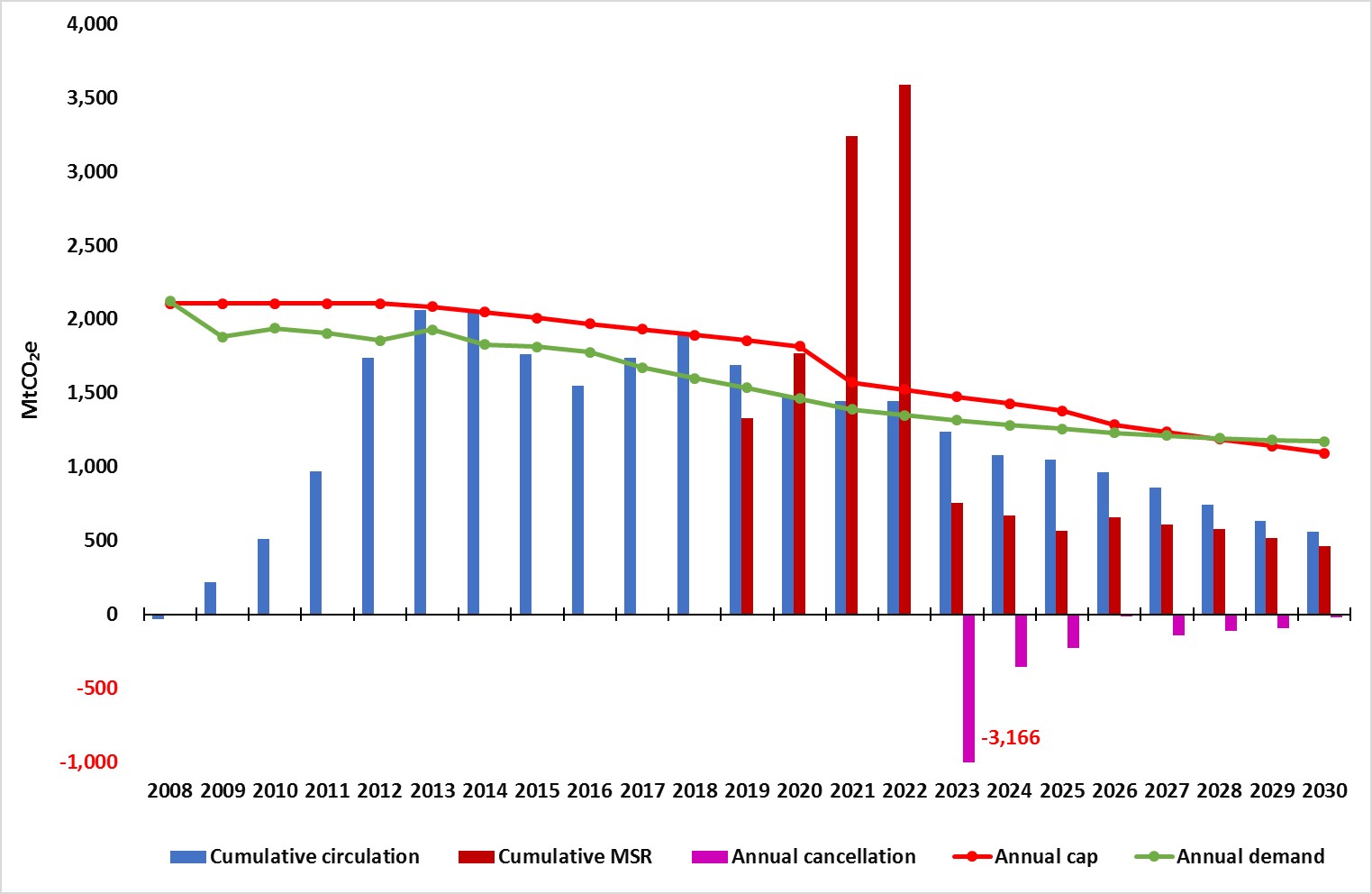

Reforms leave the ETS with a continuing enormous surplus (blue bars)

-assuming emissions reductions continue at a similar rate

Current caps and long-term targets need to be revised in light of the Paris Agreement

The main priority for the EU ETS must remain creating adequately tight supply of allowances in line with efficient and cost-effective long term decarbonisation pathways. This will enable the EU ETS to play its role in achieving cost-effective emissions reduction. It will also help funds under the ETS secure their objectives by ensuring they have greater financial value.

The level of emissions allowed in 2050 is currently uncertain by a factor of four, and this is too wide a gap for effective system design. The EU’s overall emissions target of 80-95% reduction by 2050 needs to be clarified to a single, specific emissions reduction target.

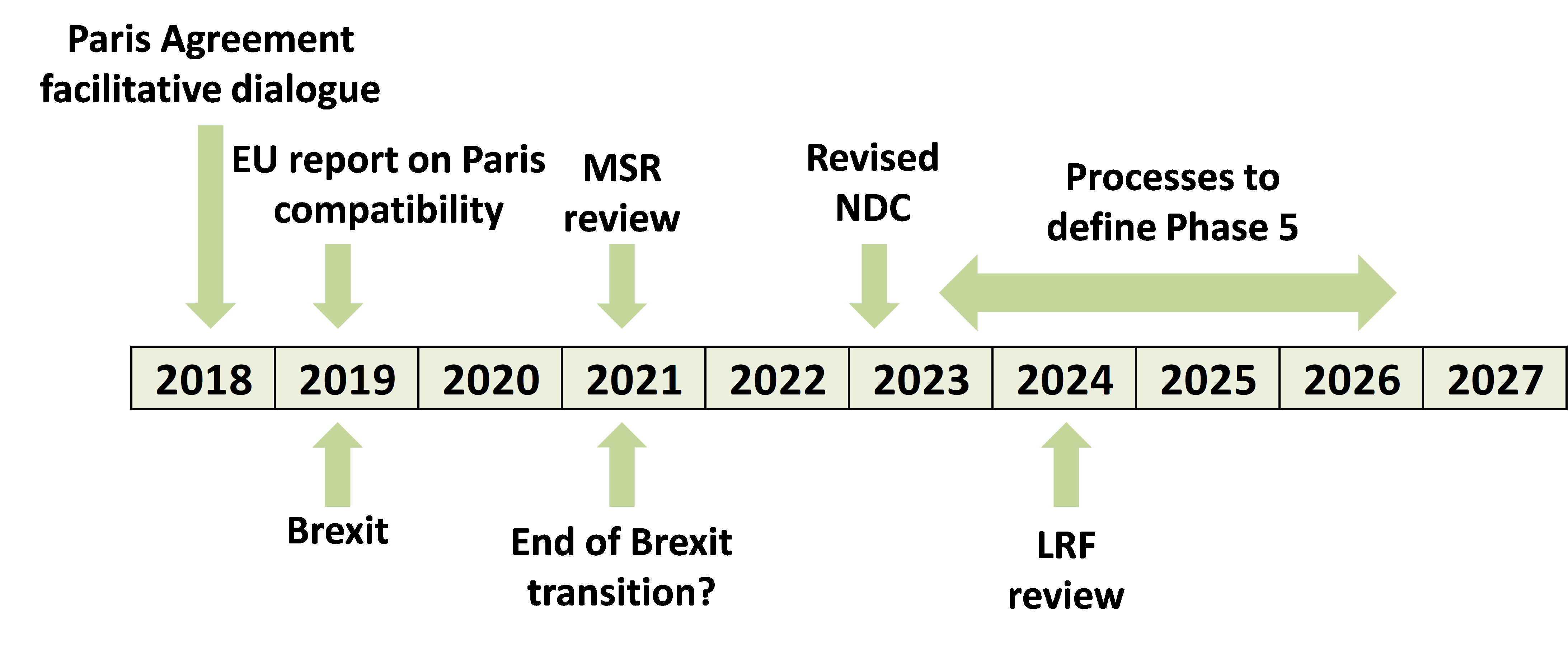

To reflect the objectives of the Paris Agreement a single, stringent long term target needs to be accompanied by a rapid path down towards this target, consistent with early peaking of global emissions, the need to severely limit cumulative emissions, and to achieve net zero emissions in the second half of this century.

The level of emissions allowed in 2050 is currently uncertain by a factor of four, and this is too wide a gap for effective system design. The EU’s overall emissions target of 80-95% reduction by 2050 needs to be clarified to a single, specific emissions reduction target.

To reflect the objectives of the Paris Agreement a single, stringent long term target needs to be accompanied by a rapid path down towards this target, consistent with early peaking of global emissions, the need to severely limit cumulative emissions, and to achieve net zero emissions in the second half of this century.

The milestones for ETS reform

Complementary measures will continue to be necessary

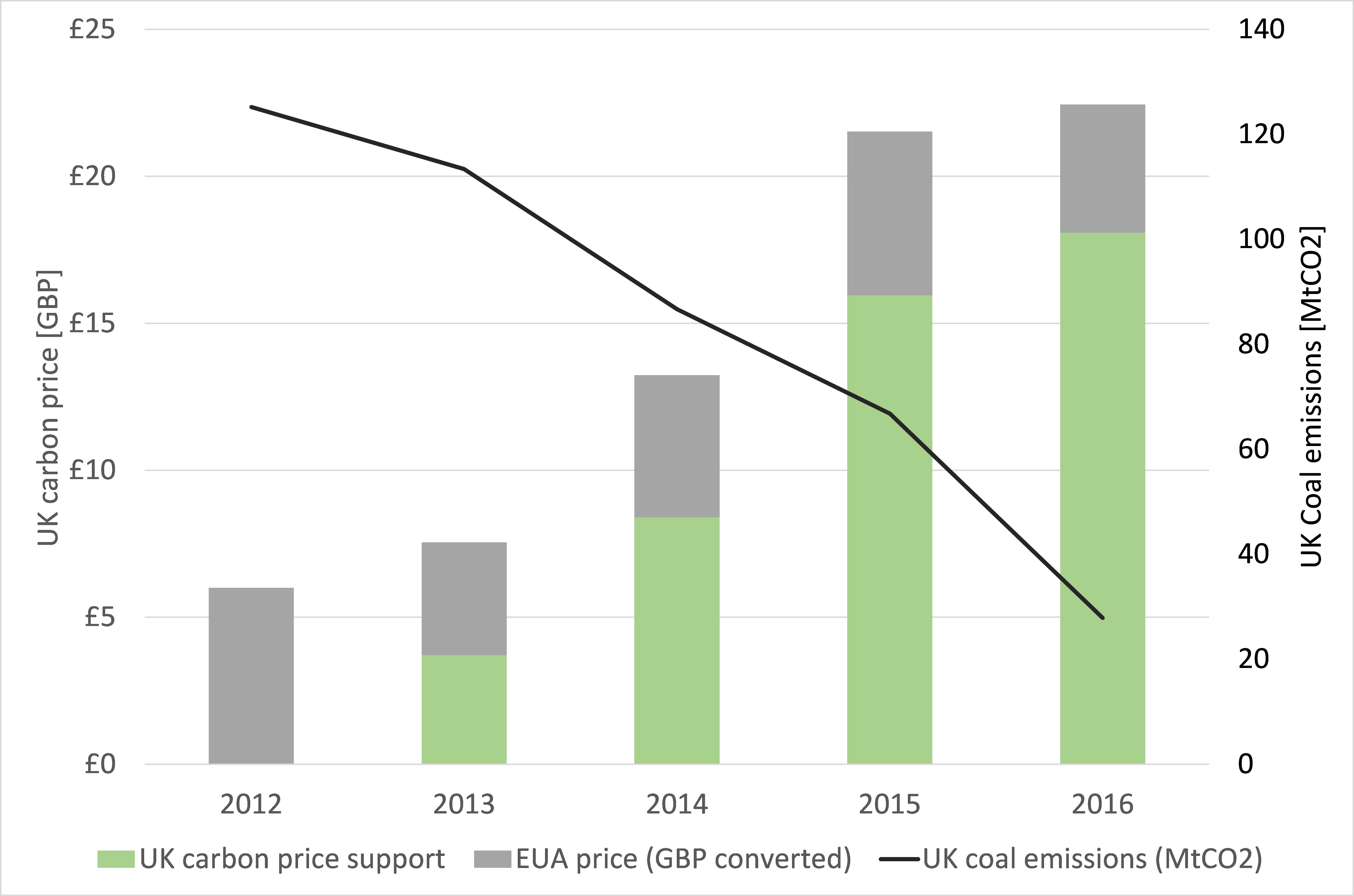

Complementary measures are essential for putting the EU, including sectors covered by the EU ETS, on the appropriate emissions trajectory. Such measures will include accelerated closure of coal plant and continuing support for the integration and deployment of renewables and energy efficiency. The presence of the EU ETS should not be used as an argument against introducing complementary measures at either the national or EU level.

The UK’s power sector carbon tax has rapidly reduced emissions from coal

New mechanisms are needed to make the ETS resilient to unexpected events

A mechanism for adjusting the cap to account for the effect of complementary measures or other factors should be considered. This should be aligned with the process of establishing revised NDCs under the Paris Agreement, with inclusion of a clear ratchet mechanism.

Adjusting supply of allowances in response to price by introducing an auction reserve price to provide a price floor would improve the economic efficiency of the EU ETS by creating more efficient price signals and stimulating investment. Similar measures have worked well elsewhere and there is every reason to suppose they would do so in the EU ETS. It is essential as part of this that the auction reserve price is at an adequate and increasing level.

The measures to improve the Market Stability Reserve (MSR) agreed in the latest reforms are welcome, especially the provisions to limit its size. Further MSR reform should include reducing thresholds. The rate of transfer, currently set at 24% for the next five years, should be further increased and extended.

Adjusting supply of allowances in response to price by introducing an auction reserve price to provide a price floor would improve the economic efficiency of the EU ETS by creating more efficient price signals and stimulating investment. Similar measures have worked well elsewhere and there is every reason to suppose they would do so in the EU ETS. It is essential as part of this that the auction reserve price is at an adequate and increasing level.

The measures to improve the Market Stability Reserve (MSR) agreed in the latest reforms are welcome, especially the provisions to limit its size. Further MSR reform should include reducing thresholds. The rate of transfer, currently set at 24% for the next five years, should be further increased and extended.

A five year ratchet mechanism could bring down the ETS surplus

– by adjusting the ETS cap to actual emissions

Continuing reform of auction revenue and carbon leakage protections

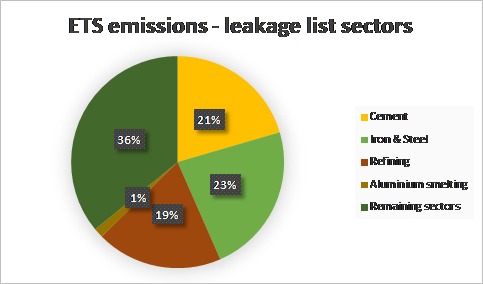

Free allocation of allowances will need to be phased out completely in the long term. This may imply introducing border carbon tariffs for sectors at risk of carbon leakage. This could start with electricity and cement with the possibility of subsequent expansion to iron and steel and oil refining.

Uses of the revenue raised by auctioning of allowances should be reviewed. There are several worthwhile uses for revenue. These include furthering emissions abatement, for example through supporting the development of new technologies and promoting energy efficiency for low income household. There are also strong arguments for using funds for adaptation, for compensating those adversely affected by climate change, and for distributing revenue directly to citizens.

As emissions continue to reduce, the advantages of expanding sectoral coverage of the EU ETS in the long term are likely to increase, and sectoral coverage should be reviewed in future. Other systems, notably in California, have shown that broad sectoral coverage can be easily implemented and can operate effectively.

Uses of the revenue raised by auctioning of allowances should be reviewed. There are several worthwhile uses for revenue. These include furthering emissions abatement, for example through supporting the development of new technologies and promoting energy efficiency for low income household. There are also strong arguments for using funds for adaptation, for compensating those adversely affected by climate change, and for distributing revenue directly to citizens.

As emissions continue to reduce, the advantages of expanding sectoral coverage of the EU ETS in the long term are likely to increase, and sectoral coverage should be reviewed in future. Other systems, notably in California, have shown that broad sectoral coverage can be easily implemented and can operate effectively.